-

Reducing the Time to Asymptote: A Framework for Thinking About the Ingredients of Scale

We’ve all seen this chart before. It is an illustration of how technology adoption has accelerated over the past 100 years. The standard telephone took over 60 years to reach 80% adoption amongst U.S. households. Cellphones reached the same milestone, but took only 20 years. Some of these technologies will peak at ~100% adoption among…

-

The Speculation Game: Industries at the Intersection of Risk and Culture

I do not count myself as a college basketball fan. In fact, I probably could not name a single player on a men’s NCAA team today. Yet, like approximately 80 million other people, I completed a bracket before the March Madness tournament kicked off last Thursday. The NCAA Division I men’s basketball tournament forms a…

-

The ‘Multiply by Zero’ Effect: Wiping Out Value Across the Banking Landscape

A product or service is simply an aggregation of its various features. Features can be ‘stackable’, where each layer of the stack adds to the overall value of the product. A checking account is great on its own. Adding free transactions makes it even better. Adding a personal financial management tool improves it even more.…

-

Communities All the Way Down

In Sapiens, Yuval Noah Harari argues that what separates man from beast is the ability to tell stories. The ability to speak about fictions is the most unique feature of Sapiens language. It enables us not simply imagine things, but to do so collectively. We can weave common myths such as the biblical creation story,…

-

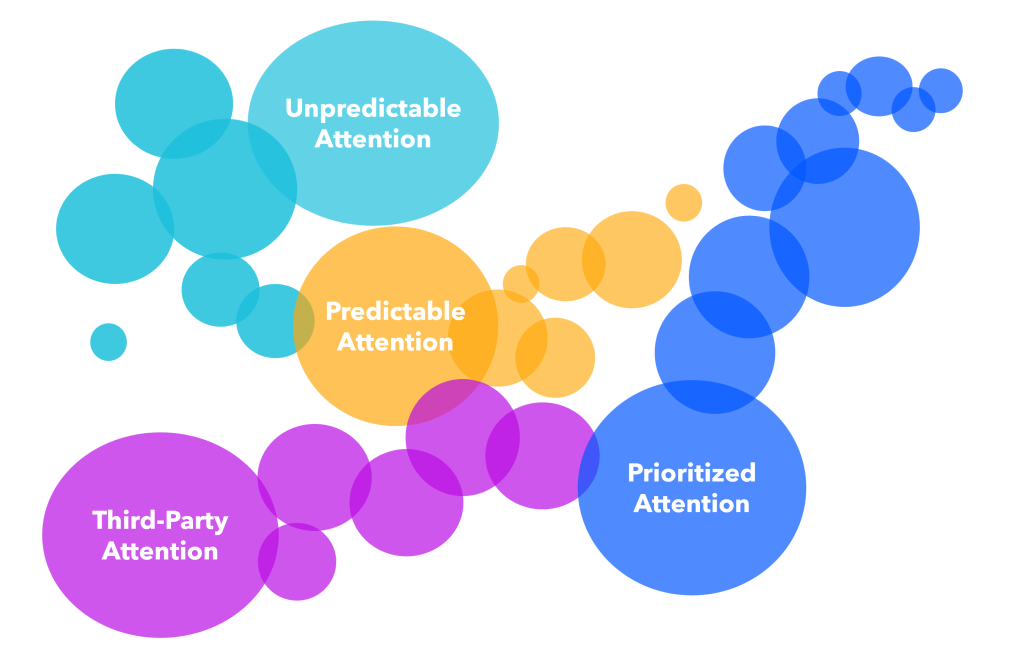

Attention Seekers: Why Financial Marketers Should Pay Attention to Attention

At the top of the funnel in traditional consumer businesses, marketers need to hunt for attention in the right places. Digital, social, print, tv, etc. Among all of the various traction channels, the goal is to find underpriced attention in the right place order to get your product/brand/message in front of the target customer. In…

-

The Most ‘Human’ Company: A Turing Test for the Corporate World

In the analog age, information was scarce. In the internet age, information was abundant and interpretation was scarce. In the artificial intelligence age, both information and interpretation are abundant. Humanness is what becomes scarce. Distinguishing Man from Machine Since the birth of the computer in the mid-20th century, building ‘humanness’ into our technological pursuits has…

-

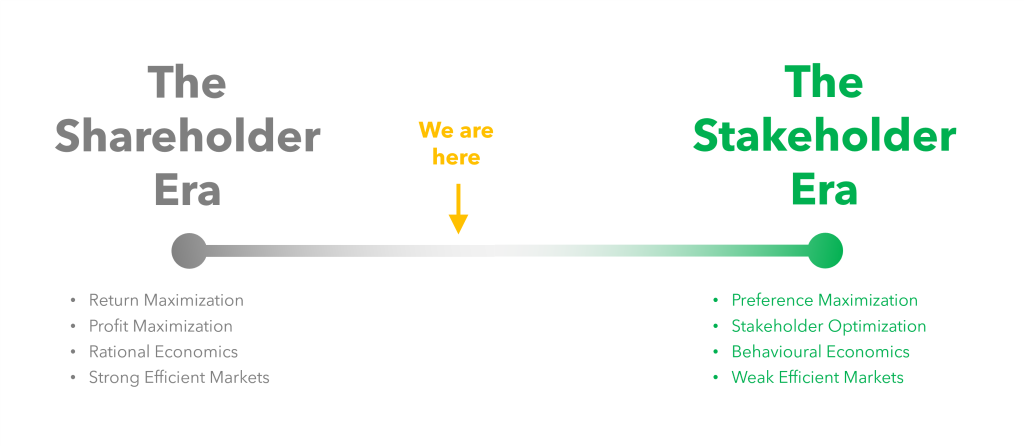

ESG Investing: Kick-starting the Shift From Shareholder to Stakeholder

ESG is one of the most discussed topics in investment management today. If you do a tour of the industry’s largest conferences in 2023, that three letter acronym—which stands for environmental, social, and (corporate) governance, btw—is likely to appear on each event’s agenda multiple times. Sustainable investing is #trending and almost every major asset manager…

-

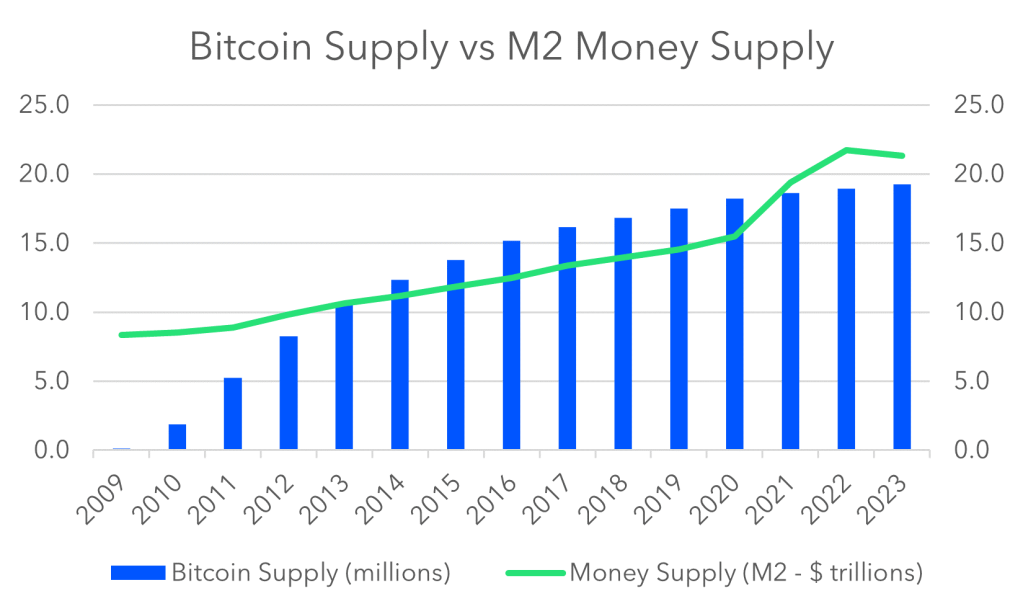

Diversification-as-a-Service: An Assortment of Crypto Correlations

There is only one free lunch in investing… and that is diversification. It is one of the only known ways to consistently improve the risk-reward equation of a portfolio. In today’s equity-centric world, bonds have typically been relied upon as the primary offset, providing diversification benefits to the everyday investor. This is particularly true when…

-

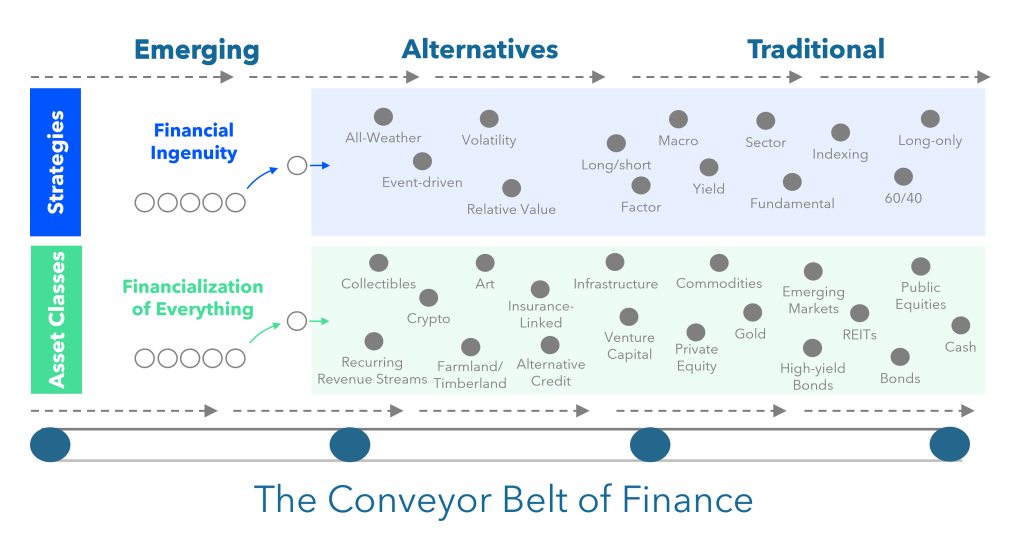

The Conveyor Belt of Finance and the Evolution of Alternative Investments

Today, it is hard to write about business without any mention of technology companies. From Apple to Amazon to Facebook, today’s tech giants are arguably the largest and most impactful organizations ever built. But when it comes to understanding this broad category, I’ve found myself asking: what exactly is a technology company? According to Investopedia,…

-

Stacks of Discretion: Who is Making Decisions About Your Money?

It is hard to choose a financial advisor! ~44% of financial advice relationships today start from a referral. Most people have trouble evaluating a financial advisory practice from the outside, so instead of spending hours scouring the internet and checking references, many people outsource the decision of whether or not a financial advisor is ‘good’…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.