-

From Points to Progress: Cyder and the Strategic Importance of Loyalty Programs

Much like physical health, financial health is a long-term game. You might not notice a visible improvement day-to-day as you finish your workout or skip the expensive latte in favor of saving a few bucks… but over time, those actions compound. Your cumulative short-term decisions add up to your long-term outcome. Your future self depends…

-

Strategy is a Storytelling Function

In Sapiens, Yuval Noah Harari argues that what separates humans from other species is not intelligence or tool use, but our ability to create and believe in shared stories. Money, nations, corporations, and laws exist only because enough people agree to act as if they are real. Organizations are no different. They do not run…

-

Premium-to-NAV, the Evolution of the Bitcoin Treasury Model, and the Case of LQWD

In what scenario would you spend $100 to acquire a freshly minted $50 bill? … there probably aren’t many. How about with a slight twist: In what scenario would you spend $100 to acquire $57 worth of Bitcoin? … in the open market, you likely won’t find this situation. But for the shareholders of MicroStrategy…

-

The MicroStrategy of Solana? Sol Strategies and the ‘Copy + Paste + Improve’ Formula

The beautiful thing about the crypto industry is its compounding nature. New ideas build upon old ideas thanks to the open-source ethos that is omnipresent in the space. Copy + Paste + Improve. That’s true for protocols themselves, where new assets improve upon old assets, new virtual machines (VMs) improve upon old VMs, and new…

-

Musings on Meme Coins: A Candy-Coated Version of Fintech Innovation

A few weeks ago, Fartcoin officially crossed the $1 billion market cap threshold. That either means the world has lost its mind, or something very interesting is going on under the hood in the innovation lab of Finance. Before meme stocks burst onto the scene with the Gamestop short squeeze in January 2021, there were…

-

The Perfect Speculative Product

Crypto is the perfect speculative product. It is always on, always liquid, and incredibly in your face. But imagine if other asset classes were this engaging. What if you could watch the market value of your home tick-by-tick, fluctuating tens of thousands of dollars every day? What if it was so easy to buy/sell homes…

-

Web3 Gateways: The App Store for Ownership

Question: where did the phrase “going down the rabbit hole” come from? Answer: It goes all the way back to Lewis Carroll’s 1865 classic “Alice’s Adventures in Wonderland.” In the novel, Alice follows a white rabbit down a rabbit hole and finds herself in a fantastical and surreal place filled with peculiar characters, magical creatures,…

-

David vs Goliath: When Advantage Tilts Toward Retail Investors

Retail or institutional, every market participant is unique. Renaissance Technologies is comprised of a cocktail of capabilities, expertise, and patient capital that others simply cannot match. Those characteristics are very different from a Millennial retail investor who stays active on investment forums, an insurance company that has to match assets to its liabilities, or a…

-

Authenticity: What to Optimize for in the Age of AI

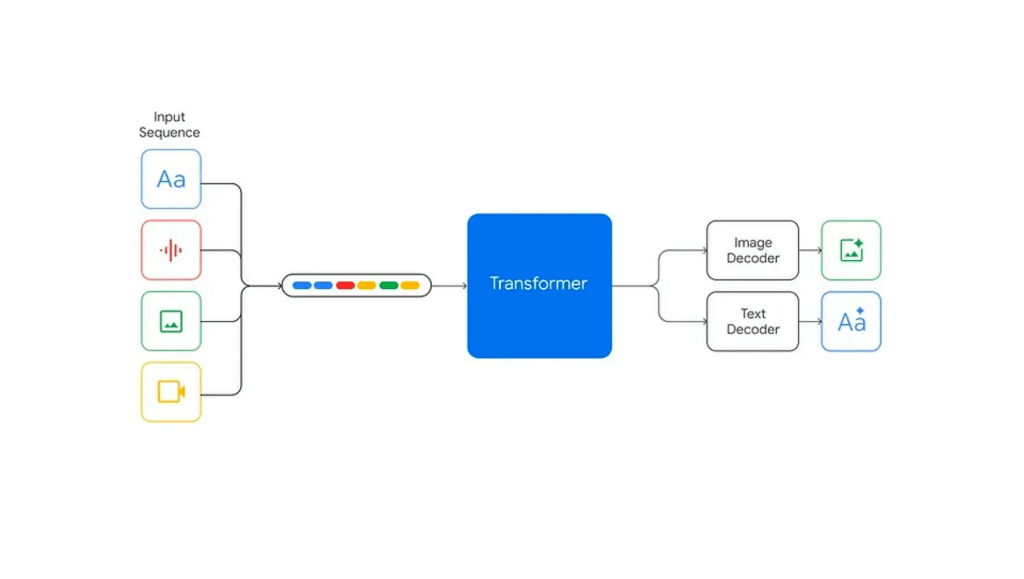

A video of Google testing Gemini, its natively multi-modal AI model, was making the rounds on the internet this week. If you haven’t stumbled across it yet, check it out below: Multi-modality is what distinguishes Gemini from other large language models (LLMs). It is trained on text, images, audio and video whereas its counterparts are…

-

The Top 25 Jobs-to-Be-Done in Retail Investing

One of the best pieces of writing advice is to write the article you wish already existed. When I set out to look for a concise list of the most common jobs-to-be-done for retail investors, particularly those who use online trading platforms, I came up rather empty (although I feel like Morgan Housel probably has…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.