Tag: Finserv

-

Financialization and the Edge of Financial Advice: Keeping Pace in a Fintech-forward World

We’ve all come across a similar story: one day Bob was fumbling around Twitter and bought an esoteric NFT. The next thing you know, Bob is a millionaire. If you’ve spent any time on crypto twitter, you know that a number of crypto millionaires have been minted since digital assets broke onto the scene over…

-

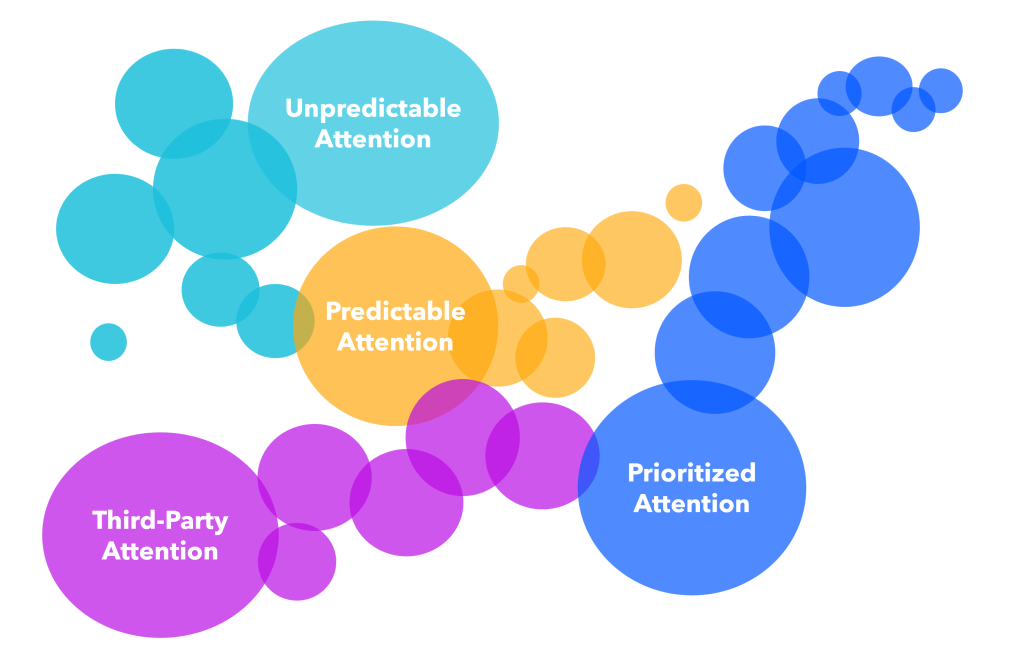

Attention Seekers: Why Financial Marketers Should Pay Attention to Attention

At the top of the funnel in traditional consumer businesses, marketers need to hunt for attention in the right places. Digital, social, print, tv, etc. Among all of the various traction channels, the goal is to find underpriced attention in the right place order to get your product/brand/message in front of the target customer. In…

-

Stacks of Discretion: Who is Making Decisions About Your Money?

It is hard to choose a financial advisor! ~44% of financial advice relationships today start from a referral. Most people have trouble evaluating a financial advisory practice from the outside, so instead of spending hours scouring the internet and checking references, many people outsource the decision of whether or not a financial advisor is ‘good’…

-

Enhancing Financial Legibility: A Technological Upgrade for Financial Services

Quick question: what is your credit score? Can you answer this on the spot? If so, my guess is that you are one of the millions of people who have accessed and tracked their credit scores for free through forward-thinking services like CreditKarma and Borrowell. Their work has made it possible for anyone to better…

-

Context is Everything: The Hidden Driver Behind Most Financial Services Innovation

Finance is a means to an end, not an end in itself. This is hard to remember sometimes when you have your head down working in the industry. The financial system exists to move, store and transform value for its various users. It is the circulatory system enabling most forms of economic activity across the…

-

Investment Tribes and the Rise of Social Trading

Investing is inherently social. Why is that the case? Well, let’s start by asking the question: What is a security? When it comes to the general applicability of the federal securities laws in the United States, the definition is quite simple. A security is: These are the four prongs of the famous ‘Howey Test’, a…

-

Quality Control: A Mental Model for Regulation

Regulation has a bad rap. It is regularly vilified as a barrier to innovation and as a contributor to costs. But every so often, we are starkly reminded of the important purpose it serves: to protect consumers and ensure industries operate as they are supposed to. There is a large part of the crypto industry…

-

Knocking Down The Wall of Switching Costs: Acquiring Customers in Mature Industries

Have you ever smashed a TV with a baseball bat…? Yeah, me neither. But thousands of people have in the safety of a controlled environment known as a ‘rage room’. Every single day, a collection of frustrated executives, divorcees and whoever else requires a little cathartic release pay money to go destroy some objects and…

-

Strategic Alpha, Strategic Beta: Winning by Escaping the Obvious

Thought experiment: If you took the corporate strategy departments of the Big Five banks in Canada and asked them to come up with a 5-year strategic plan calibrated to today’s environment, how much variance would exist in the five plans produced? How about if you did the same with the Big Four banks in Australia?…

-

Feature-Elasticity: Why 1% Financial Advice Fees Are Safe, But Trading Revenue is Not

I was recently listening to Michael Kitces (Financial Advice Industry Guru) talk to Joe Duran (Head of Goldman Sachs Personal Financial Management) about the competitive dynamic in the financial advice industry and how it had shifted over the past few years. Joe provided commentary on three big predictions he had made that have started to…