-

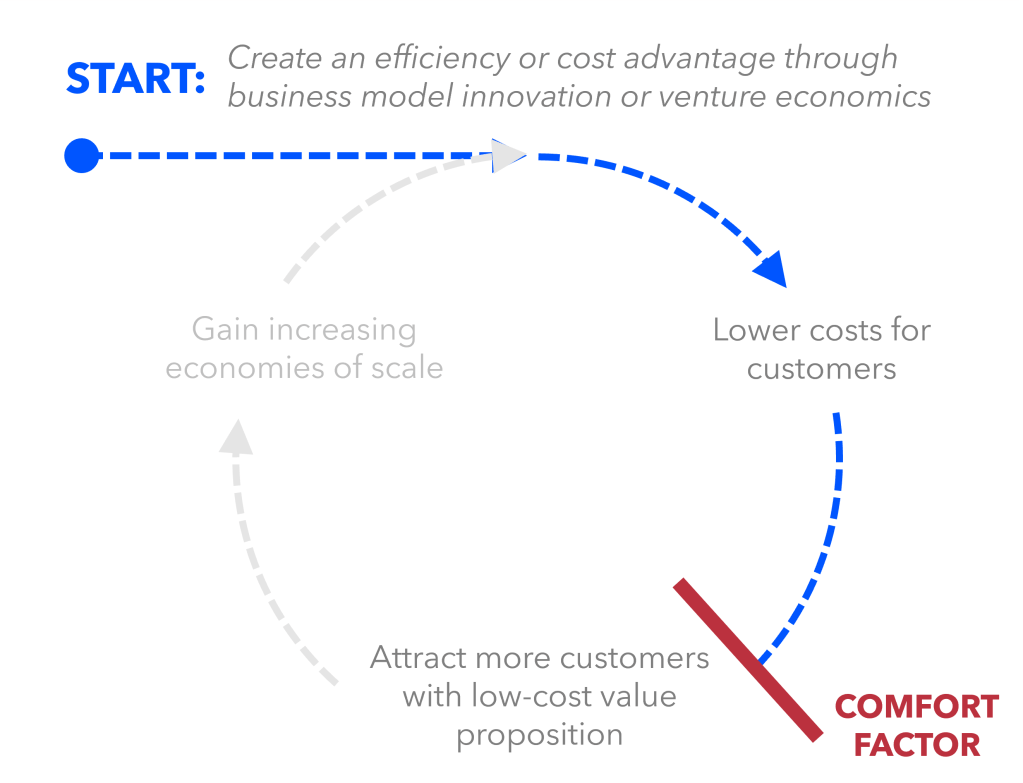

The Comfort Factor: Why Cost Leadership is a Not a Practical Strategy in Retail Financial Services

For years, fintech has pushed the narrative that the existing financial stack is inefficient, built for an analog paper-based age with entrenched business models that have significant room to modernize. An assumed by-product of this inefficiency was increased costs for financial services customers. The higher the layers of people, intermediaries and batch processes were stacked,…

-

Enhancing Financial Legibility: A Technological Upgrade for Financial Services

Quick question: what is your credit score? Can you answer this on the spot? If so, my guess is that you are one of the millions of people who have accessed and tracked their credit scores for free through forward-thinking services like CreditKarma and Borrowell. Their work has made it possible for anyone to better…

-

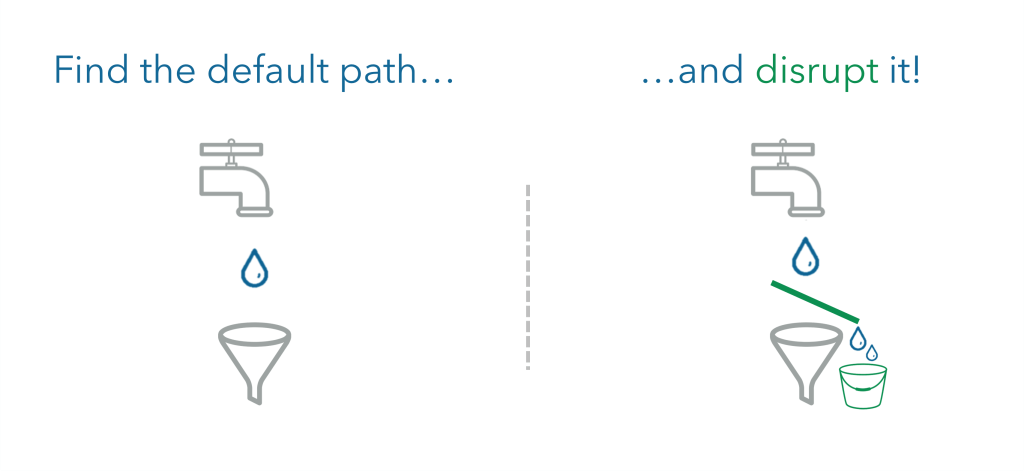

The Default Path: A Moat Worth Defending

Life is busy, the world is noisy, and it seems to get more so each year. When attention is increasingly scarce, we rely more heavily on the default path. The default path is the option that is automatically selected unless an alternative is specified. It is the first thing to come to mind when making…

-

Context is Everything: The Hidden Driver Behind Most Financial Services Innovation

Finance is a means to an end, not an end in itself. This is hard to remember sometimes when you have your head down working in the industry. The financial system exists to move, store and transform value for its various users. It is the circulatory system enabling most forms of economic activity across the…

-

Investment Tribes and the Rise of Social Trading

Investing is inherently social. Why is that the case? Well, let’s start by asking the question: What is a security? When it comes to the general applicability of the federal securities laws in the United States, the definition is quite simple. A security is: These are the four prongs of the famous ‘Howey Test’, a…

-

The Temporal Theory of Disruptive Innovation

Back in my research/consulting days, I made the rounds with a presentation titled: The Attention Imperative in Financial Services. To briefly summarize its contents: Wealth management firms have a hard time acquiring clients. Customer acquisition costs (CAC) can be upwards of $2,000. Why? Because clients do not live their lives with the ‘long-term’ top-of-mind. That…

-

Finance Tiktok: Bringing the #Money Conversation into the Light

People do not like to talk about finance on a personal level. How much did your significant other make last year? What does your cousin’s investment portfolio look like? How much debt did your newly wed friends take-on to afford a house… in that neighbourhood? Money is a taboo topic in culture today. It can…

-

Quality Control: A Mental Model for Regulation

Regulation has a bad rap. It is regularly vilified as a barrier to innovation and as a contributor to costs. But every so often, we are starkly reminded of the important purpose it serves: to protect consumers and ensure industries operate as they are supposed to. There is a large part of the crypto industry…

-

Money Crypto, Tech Crypto, Culture Crypto

In 2018, Village Global published a simple framework that split crypto into two factions: Money Crypto and Tech Crypto Money Crypto: Maintains that the point of cryptocurrency is to redefine how money works by (re)introducing ‘sound money’. Sound money is money that: has either a fixed supply or a predictable inflation rate; doesn’t appreciate quickly, and;…

-

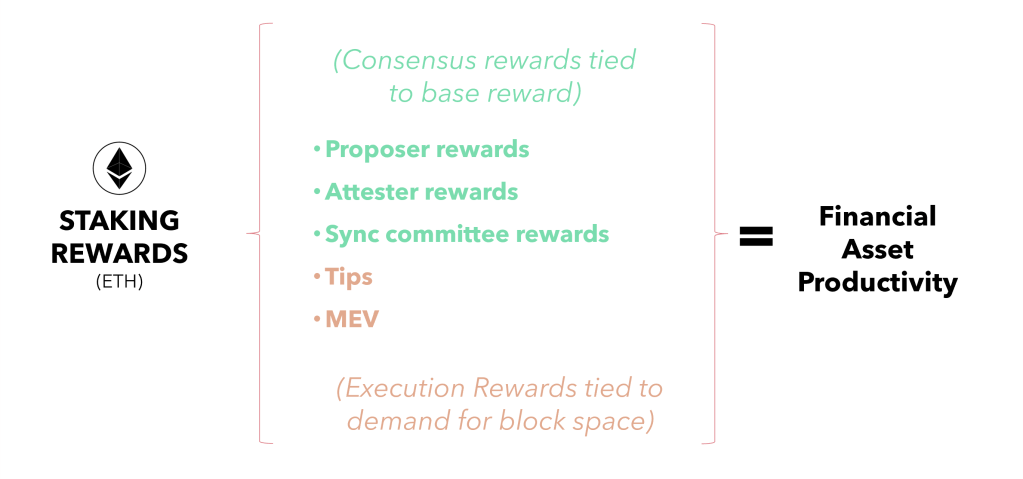

Why Staking Matters

Question: Why does staking matter? Answer: Financial asset productivity. Let me explain. What is Staking? Staking is a process by which a crypto asset owner can lock up their coins in order to participate in running a blockchain and maintaining its security. Of course, this is only true for blockchains that use a proof-of-stake (POS) consensus…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.