Category: Fintech

-

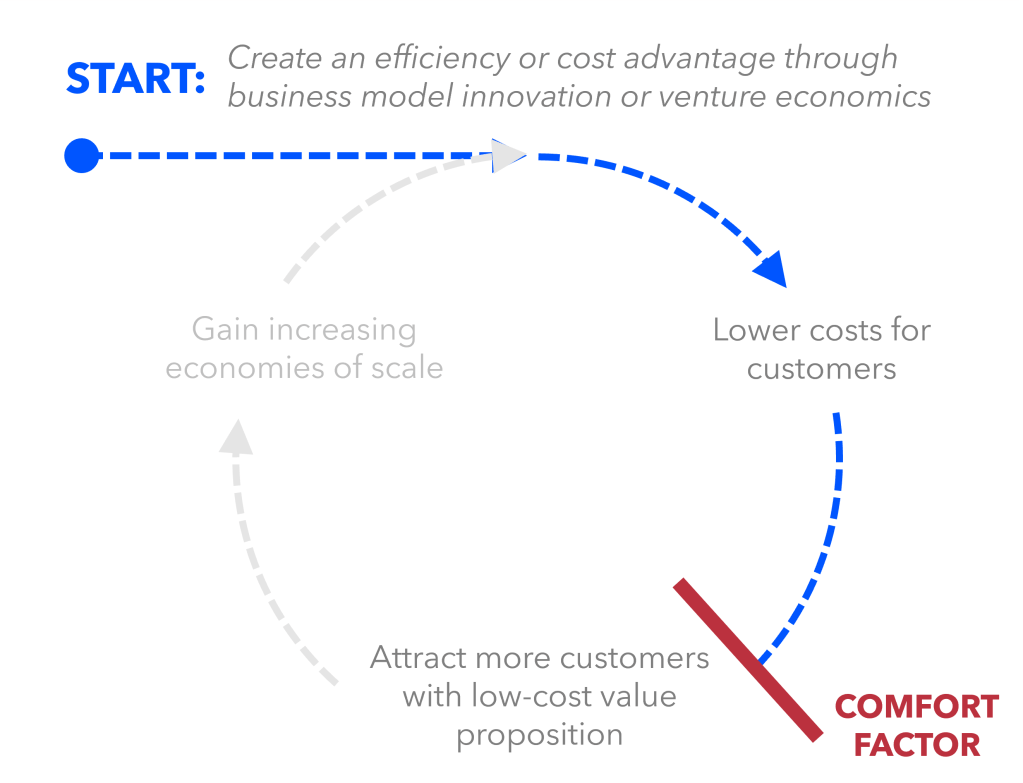

The Comfort Factor: Why Cost Leadership is a Not a Practical Strategy in Retail Financial Services

For years, fintech has pushed the narrative that the existing financial stack is inefficient, built for an analog paper-based age with entrenched business models that have significant room to modernize. An assumed by-product of this inefficiency was increased costs for financial services customers. The higher the layers of people, intermediaries and batch processes were stacked,…

-

Enhancing Financial Legibility: A Technological Upgrade for Financial Services

Quick question: what is your credit score? Can you answer this on the spot? If so, my guess is that you are one of the millions of people who have accessed and tracked their credit scores for free through forward-thinking services like CreditKarma and Borrowell. Their work has made it possible for anyone to better…

-

Context is Everything: The Hidden Driver Behind Most Financial Services Innovation

Finance is a means to an end, not an end in itself. This is hard to remember sometimes when you have your head down working in the industry. The financial system exists to move, store and transform value for its various users. It is the circulatory system enabling most forms of economic activity across the…

-

Investment Tribes and the Rise of Social Trading

Investing is inherently social. Why is that the case? Well, let’s start by asking the question: What is a security? When it comes to the general applicability of the federal securities laws in the United States, the definition is quite simple. A security is: These are the four prongs of the famous ‘Howey Test’, a…

-

The Temporal Theory of Disruptive Innovation

Back in my research/consulting days, I made the rounds with a presentation titled: The Attention Imperative in Financial Services. To briefly summarize its contents: Wealth management firms have a hard time acquiring clients. Customer acquisition costs (CAC) can be upwards of $2,000. Why? Because clients do not live their lives with the ‘long-term’ top-of-mind. That…

-

Money Crypto, Tech Crypto, Culture Crypto

In 2018, Village Global published a simple framework that split crypto into two factions: Money Crypto and Tech Crypto Money Crypto: Maintains that the point of cryptocurrency is to redefine how money works by (re)introducing ‘sound money’. Sound money is money that: has either a fixed supply or a predictable inflation rate; doesn’t appreciate quickly, and;…

-

Strategic Alpha, Strategic Beta: Winning by Escaping the Obvious

Thought experiment: If you took the corporate strategy departments of the Big Five banks in Canada and asked them to come up with a 5-year strategic plan calibrated to today’s environment, how much variance would exist in the five plans produced? How about if you did the same with the Big Four banks in Australia?…

-

In Praise of HODL: Creating Owners Out of Speculators

We Need More Owners Carta deserves our respect: their mission “to create more owners” is ambitious and subtly takes on the global challenge of income/wealth inequality. Credit unions are in the same boat: they are financial institutions owned by their members that (in some instances) return capital to their members each year in the form…

-

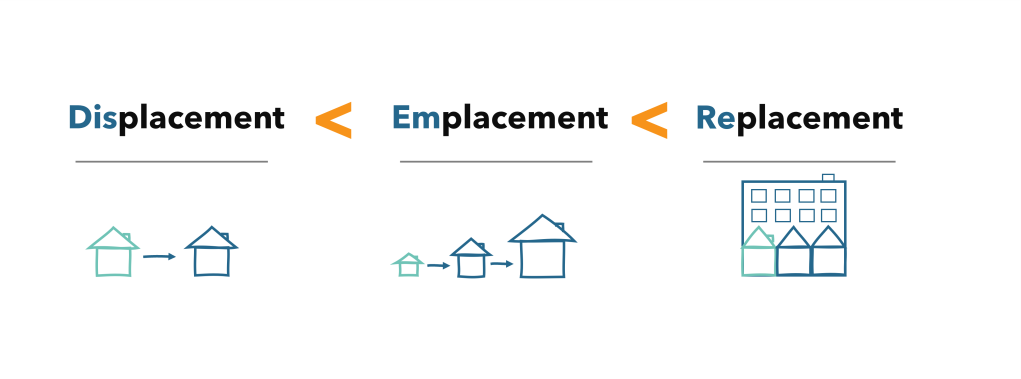

Displacement, Not Replacement

#BankLoyalty is strong. Ask the average Baby Boomer how long they’ve had the same bank account with their primary financial institution and 56% will tell you more than 21 years. Call it loyalty, call it inertia. Whatever it is, it makes it incredibly hard for start-ups and new companies to build scalable businesses and bring…

-

Financial Services: Are we Missing the Forest for the Trees?

[Originally published in November 2019]. “What is the point of finance?” This question was asked to me by a curious seven-year-old after I had told him what I do for a living. I paused for a second, almost disturbed that I didn’t have an automatic answer… At its roots, finance is about the allocation of…