#BankLoyalty is strong. Ask the average Baby Boomer how long they’ve had the same bank account with their primary financial institution and 56% will tell you more than 21 years.

Call it loyalty, call it inertia. Whatever it is, it makes it incredibly hard for start-ups and new companies to build scalable businesses and bring change to the finance industry.

The often pointed-to solution for tackling this problem is the traditional 10x rule. Create a product that delivers so much more value than the status quo, that consumers will have no choice but to pay attention and switch.

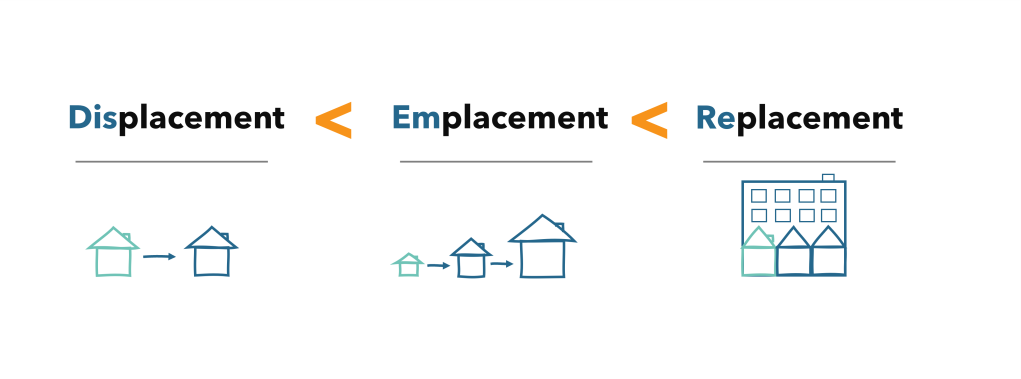

This is the replacement strategy, and it has historically been a tough path.

Many companies have tried, building much smoother user experiences, with more modern features, with more personalized insights, and all at a much lower price point. But even with a substantially better product, most companies are still unable to break the forces that bind most people to their banks. It drives them to compete head-to-head, a game in which inertia often wins out.

That’s not to say there haven’t been some big wins. Wealthsimple is well on its way to replacing banks as the go to financial services provider in Canada for Millennials and Gen Z. Square now owns and occupies prime real estate on the smartphones of 24 million Americans and counting. SoFi has been successful in becoming a leading option in the student lending market. Revolut, despite its bumps along the way, has become a worthy competitor rebundling fintech into a full-stack financial services competitor. But do these firms have the same balance sheet, assets under administration, or customer base as the leading FIs. Not quite (not yet), at least. Replacement can work, it just requires a lot of persistence to convince consumers that there is a better way and to provide them with incentives that creates the activation energy necessary to make the leap.

How about another path: traditional disruptive innovation. Build for an underserved segment that the incumbent firms are not paying attention to and use that as a wedge to build outwards. Netflix did it with aged content libraries, why not in the financial services world.

This is the emplacement path, putting the company in the right niche in the industry to succeed, and it gets closer to solving the problem. Build financial products for new immigrants who lack credit history (and potentially current employment). Build investment products for small accounts since banks tailor their services to those with higher balances. Adjudicate credit more flexibly for people stuck in the cycle of payday lending. Build a service so strong for a niche that has a specific problem to be addressed and generalize it outward to the rest of the population.

This has generally worked better than direct replacement. It’s targeting underserved segments, who by definition have weaker financial ties (if any) to existing providers. Arguably the four examples above fall into this category after a bout with pursuing replacement.

But what is being done for these segments often isn’t building a better mousetrap. It’s traditionally taking the existing mousetrap structure and personalizing it or opening it up to a new segment of the population. Sure, you could argue better pricing, or digitally-native features, or improved underwriting criteria is a better product on the surface – but the underlying function, processes, and supporting infrastructure is all the same. The ultimate test: is the better product luring away people from outside the initial niche of focus at a pace that’s faster than a slow drip? In some cases yes, in some cases, no.

That leaves one more strategy: displacement. If competing head-to-head doesn’t work fast enough, nor does occupying the underserved niches in the industry, then perhaps the only alternative is to build an entirely new financial system from scratch, complete with digitally-native characteristics suited to the modern world, and migrate customers and firms over from the old rails to the new ones.

While that sounds like a lot of work that likely isn’t feasible for any one company, that’s exactly what is taking place in the cryptocurrency arena today. Yesterday’s financial system was created at a time when paper-based and physical processes ruled finance. We eventually put a digital layer on top of those old analog processes, but the underlying structures [and the challenges they created] remained.

Crypto provides a what if scenario: what if we built money suited to the 21st century? What if money and the system that moved and secured it was digitally native, complete with all of the features of modern day software: programmable, interoperable, permissionless, borderless, low cost, and incredibly fast to settle?

This is the system that has been created. It started with Bitcoin, graduated to the world computer through Ethereum, became an insanity party with ICOs and IEOs, and then hatched the beginnings of DeFi, Web3, stablecoins, DAOs and many other notable projects that couldn’t have been predicted years ago… and also would not be possible without the digitally-native characteristics that come from building a new system from scratch.

Crypto is a new rail displacing traditional clearing and settlement; DeFi protocols are the new financial primitives on top (displacing traditional financial and capital markets functions); and wallets are the new interface – displacing banks and [potentially] other fintech firms.

As this parallel financial system has been built, it has bootstrapped itself by becoming its own central bank. Projects spin up and issue money [tokens] that can fund their development. It is self-sustaining, self-sufficient, incredibly volatile, and still isolated as a closed system.

Of course, with most of the activity in the system taking place outside the watchful eye of regulators, it has attracted frauds, scams, and a variety of reckless [highly leveraged] financial behaviour. Without regulation, there have been very few examples of traditional financial services crossing over into crypto. Displacement hasn’t taken place. However, there are a few hints that things are changing…

Stablecoins are a good example. Fiat-backed stablecoins, the now de facto standard after the collapse of Terra, leverage a basket of cash and equivalents and tokenize their value on-chain to serve freely in the crypto ecosystem. This is done with relatively safe assets in fully collateralized situations. It’s also being done with riskier assets in overcollateralized situations (see Huntingdon Valley Bank’s use of MakerDAO’s stablecoin value system).

With each integration, displacement takes a step forward. While stablecoins are one example, the possibilities are endless. This is particularly true of DeFi, whose primitives compete to become more efficient and effective over time. The leading DeFi lenders, automated market makers, yield aggregators, asset managers, insurers and more continue to evolve their services every day. Beyond stablecoins, the efficiency of DeFi services is likely the next magnet to attract the attention of the regulated financial services world. And as each primitive sees more use, the slow and steady process of replacing our old analog infrastructure with the new digitally-native version will continue.

Displacement isn’t really a strategy, it’s more of a story that we can only fit to what’s taken place with the benefit of hindsight. Crypto isn’t ready for primetime yet, but with evidence mounting, the first chapters are starting to be written…