Category: Crypto

-

Crypto Inception: A Theory of Mainstream Adoption from NFTs to Institutional DeFi

Crypto is LOUD. Headlines, trials, frauds, scams, degens, lambos, WAGMI, million dollar jpegs, maxis… the last wave of crypto was brash and ‘in your face’. Every industry headline seems to come with an exclamation point next to it! That’s a feature, not a bug. Early days-crypto was on a mission to replace money itself and…

-

Context is Everything: The Hidden Driver Behind Most Financial Services Innovation

Finance is a means to an end, not an end in itself. This is hard to remember sometimes when you have your head down working in the industry. The financial system exists to move, store and transform value for its various users. It is the circulatory system enabling most forms of economic activity across the…

-

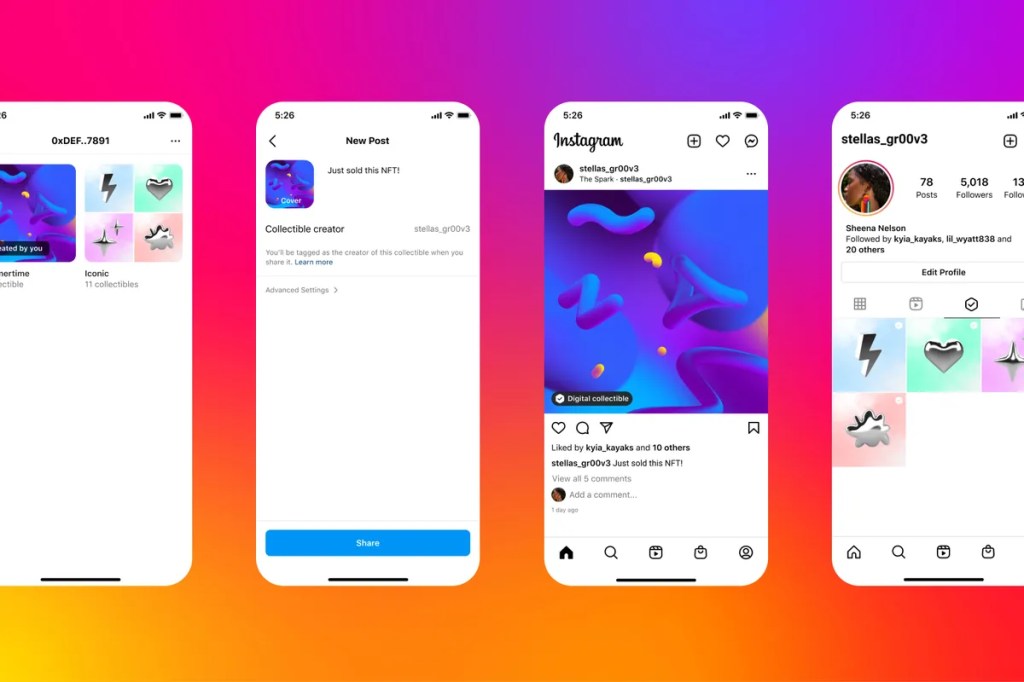

Investment Tribes and the Rise of Social Trading

Investing is inherently social. Why is that the case? Well, let’s start by asking the question: What is a security? When it comes to the general applicability of the federal securities laws in the United States, the definition is quite simple. A security is: These are the four prongs of the famous ‘Howey Test’, a…

-

Quality Control: A Mental Model for Regulation

Regulation has a bad rap. It is regularly vilified as a barrier to innovation and as a contributor to costs. But every so often, we are starkly reminded of the important purpose it serves: to protect consumers and ensure industries operate as they are supposed to. There is a large part of the crypto industry…

-

Money Crypto, Tech Crypto, Culture Crypto

In 2018, Village Global published a simple framework that split crypto into two factions: Money Crypto and Tech Crypto Money Crypto: Maintains that the point of cryptocurrency is to redefine how money works by (re)introducing ‘sound money’. Sound money is money that: has either a fixed supply or a predictable inflation rate; doesn’t appreciate quickly, and;…

-

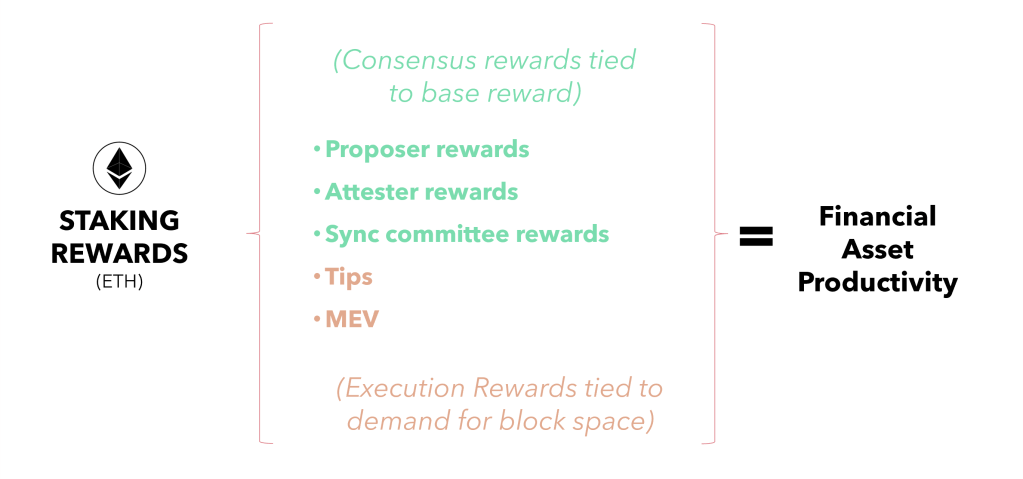

Why Staking Matters

Question: Why does staking matter? Answer: Financial asset productivity. Let me explain. What is Staking? Staking is a process by which a crypto asset owner can lock up their coins in order to participate in running a blockchain and maintaining its security. Of course, this is only true for blockchains that use a proof-of-stake (POS) consensus…

-

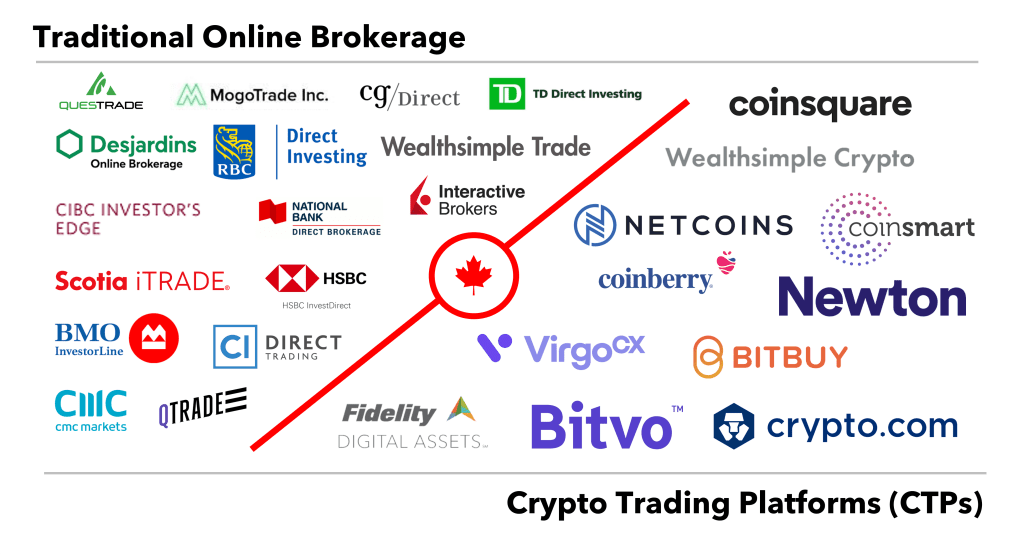

Online Brokerage Goes Crypto: How the Past Informs the Future of Regulated Crypto Trading in Canada

[Update: This post was originally written on November 1st, ten days before FTX filed for bankruptcy. Subsequent to the fallout, the Canadian Securities Administrators (CSA) strengthened its approach to oversight of crypto trading platforms by expanding existing requirements for platforms operating in Canada. This included strong words for unregistered trading platforms (including those located outside…

-

Bitcoin as an Inflation Hedge: Is it as Simple as This?

Bitcoin’s uses cases are many (self-sovereignty, payments/money movement, social signaling, etc.), but two perhaps float to the top of the narrative pile when you talk to enough people about it: bitcoin as an inflation hedge and bitcoin as a speculative asset. While both are reasons to invest, the reasoning is very different. Bitcoin as an…

-

Crypto Rewards: A Formula Fusing the Superpower of Digital Assets with Traditional Products

Crypto digital banking firm Juno has raised $18 million in a Series A funding round to expand products and operations and launch its first tokenized loyalty program… -CoinDesk This is eye catching. Juno, for all intents and purposes, is the world’s most crypto-friendly checking account. Backed by Evolve Bank & Trust, like a traditional…

-

The Ultimate Disintermediator of Financial Labor

Labour vs Capital has always had an interesting dynamic in economic theory. They are the two of the three main productive outputs of the economy, at least according to the Cobb-Douglas production function (the third being technology, or ‘total factor productivity’—TFP). In recent times, the dynamic has shifted. Labor’s share of income has fallen while…