Category: Fintech

-

From Points to Progress: Cyder and the Strategic Importance of Loyalty Programs

Much like physical health, financial health is a long-term game. You might not notice a visible improvement day-to-day as you finish your workout or skip the expensive latte in favor of saving a few bucks… but over time, those actions compound. Your cumulative short-term decisions add up to your long-term outcome. Your future self depends…

-

The MicroStrategy of Solana? Sol Strategies and the ‘Copy + Paste + Improve’ Formula

The beautiful thing about the crypto industry is its compounding nature. New ideas build upon old ideas thanks to the open-source ethos that is omnipresent in the space. Copy + Paste + Improve. That’s true for protocols themselves, where new assets improve upon old assets, new virtual machines (VMs) improve upon old VMs, and new…

-

Musings on Meme Coins: A Candy-Coated Version of Fintech Innovation

A few weeks ago, Fartcoin officially crossed the $1 billion market cap threshold. That either means the world has lost its mind, or something very interesting is going on under the hood in the innovation lab of Finance. Before meme stocks burst onto the scene with the Gamestop short squeeze in January 2021, there were…

-

Web3 Gateways: The App Store for Ownership

Question: where did the phrase “going down the rabbit hole” come from? Answer: It goes all the way back to Lewis Carroll’s 1865 classic “Alice’s Adventures in Wonderland.” In the novel, Alice follows a white rabbit down a rabbit hole and finds herself in a fantastical and surreal place filled with peculiar characters, magical creatures,…

-

David vs Goliath: When Advantage Tilts Toward Retail Investors

Retail or institutional, every market participant is unique. Renaissance Technologies is comprised of a cocktail of capabilities, expertise, and patient capital that others simply cannot match. Those characteristics are very different from a Millennial retail investor who stays active on investment forums, an insurance company that has to match assets to its liabilities, or a…

-

Open Beats Closed: Why Crypto Deserves Our Attention

What do someone from a large money center bank, a small local credit union, a mid-sized RIA, a fixed-income trading desk, and a payment services provider have in common? Well, it is the same thing everyone in finance has in common: they should be paying attention to crypto. Perhaps it is not at the top…

-

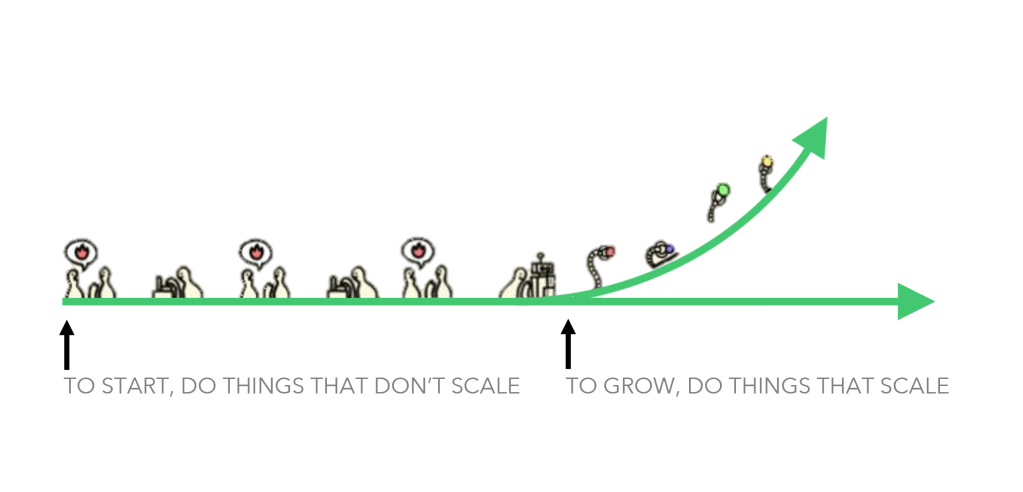

Unlocking Dormant Supply and The Strategy of Doing Things That Don’t Scale: The Case Study of Canada’s Neo Financial

“Do things that don’t scale”. This common advice, often bestowed upon start-up founders—particularly those going through Y Combinator—was popularized by Paul Graham in a 2013 blog post. The crux of his argument was that a start-up’s biggest advantage is its speed and ability to adapt and what better way to learn what customers want then…

-

Financialization and the Edge of Financial Advice: Keeping Pace in a Fintech-forward World

We’ve all come across a similar story: one day Bob was fumbling around Twitter and bought an esoteric NFT. The next thing you know, Bob is a millionaire. If you’ve spent any time on crypto twitter, you know that a number of crypto millionaires have been minted since digital assets broke onto the scene over…

-

The Speculation Game: Industries at the Intersection of Risk and Culture

I do not count myself as a college basketball fan. In fact, I probably could not name a single player on a men’s NCAA team today. Yet, like approximately 80 million other people, I completed a bracket before the March Madness tournament kicked off last Thursday. The NCAA Division I men’s basketball tournament forms a…

-

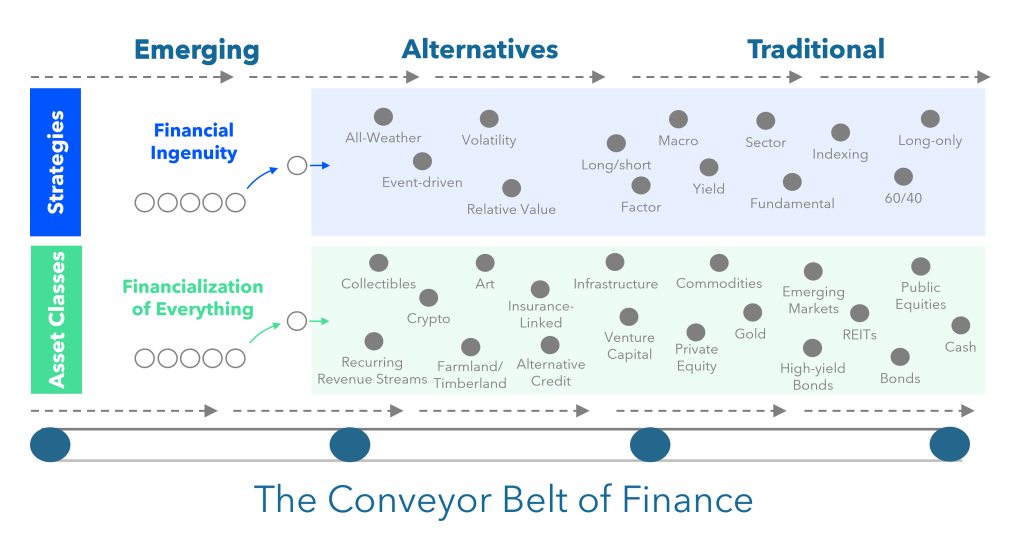

The Conveyor Belt of Finance and the Evolution of Alternative Investments

Today, it is hard to write about business without any mention of technology companies. From Apple to Amazon to Facebook, today’s tech giants are arguably the largest and most impactful organizations ever built. But when it comes to understanding this broad category, I’ve found myself asking: what exactly is a technology company? According to Investopedia,…