Category: Financial Services

-

From Points to Progress: Cyder and the Strategic Importance of Loyalty Programs

Much like physical health, financial health is a long-term game. You might not notice a visible improvement day-to-day as you finish your workout or skip the expensive latte in favor of saving a few bucks… but over time, those actions compound. Your cumulative short-term decisions add up to your long-term outcome. Your future self depends…

-

Web3 Gateways: The App Store for Ownership

Question: where did the phrase “going down the rabbit hole” come from? Answer: It goes all the way back to Lewis Carroll’s 1865 classic “Alice’s Adventures in Wonderland.” In the novel, Alice follows a white rabbit down a rabbit hole and finds herself in a fantastical and surreal place filled with peculiar characters, magical creatures,…

-

David vs Goliath: When Advantage Tilts Toward Retail Investors

Retail or institutional, every market participant is unique. Renaissance Technologies is comprised of a cocktail of capabilities, expertise, and patient capital that others simply cannot match. Those characteristics are very different from a Millennial retail investor who stays active on investment forums, an insurance company that has to match assets to its liabilities, or a…

-

The Top 25 Jobs-to-Be-Done in Retail Investing

One of the best pieces of writing advice is to write the article you wish already existed. When I set out to look for a concise list of the most common jobs-to-be-done for retail investors, particularly those who use online trading platforms, I came up rather empty (although I feel like Morgan Housel probably has…

-

Open Beats Closed: Why Crypto Deserves Our Attention

What do someone from a large money center bank, a small local credit union, a mid-sized RIA, a fixed-income trading desk, and a payment services provider have in common? Well, it is the same thing everyone in finance has in common: they should be paying attention to crypto. Perhaps it is not at the top…

-

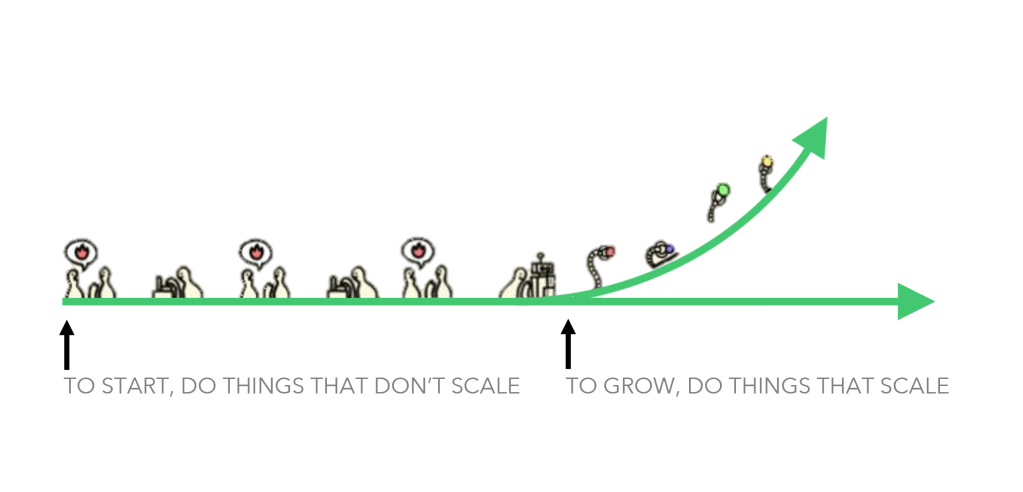

Unlocking Dormant Supply and The Strategy of Doing Things That Don’t Scale: The Case Study of Canada’s Neo Financial

“Do things that don’t scale”. This common advice, often bestowed upon start-up founders—particularly those going through Y Combinator—was popularized by Paul Graham in a 2013 blog post. The crux of his argument was that a start-up’s biggest advantage is its speed and ability to adapt and what better way to learn what customers want then…

-

Financialization and the Edge of Financial Advice: Keeping Pace in a Fintech-forward World

We’ve all come across a similar story: one day Bob was fumbling around Twitter and bought an esoteric NFT. The next thing you know, Bob is a millionaire. If you’ve spent any time on crypto twitter, you know that a number of crypto millionaires have been minted since digital assets broke onto the scene over…

-

Revenue Mirages: When to Ditch an Ephemeral Revenue Line

Last week, Lyft reported their second quarter earnings, and the release contained an interesting nugget about their future pricing plans. As per TechCrunch: Lyft’s revenue per rider decreased almost 5% quarter-over-quarter, while the number of active riders increased in the second quarter to 21,487 riders, up from 19,552 in the first quarter. Lyft appears to…

-

The Speculation Game: Industries at the Intersection of Risk and Culture

I do not count myself as a college basketball fan. In fact, I probably could not name a single player on a men’s NCAA team today. Yet, like approximately 80 million other people, I completed a bracket before the March Madness tournament kicked off last Thursday. The NCAA Division I men’s basketball tournament forms a…

-

The ‘Multiply by Zero’ Effect: Wiping Out Value Across the Banking Landscape

A product or service is simply an aggregation of its various features. Features can be ‘stackable’, where each layer of the stack adds to the overall value of the product. A checking account is great on its own. Adding free transactions makes it even better. Adding a personal financial management tool improves it even more.…