One of the best pieces of writing advice is to write the article you wish already existed.

When I set out to look for a concise list of the most common jobs-to-be-done for retail investors, particularly those who use online trading platforms, I came up rather empty (although I feel like Morgan Housel probably has a list like this kicking around somewhere). I even resorted to having a conversation with ChatGPT to enlist some help from my favorite LLM, but the conversation only returned some high-level categories.

Why do we invest? And more specifically, why do some of us invest on our own? On its face, it seems like a straightforward question. But like those who have studied the progress people seek to make in their lives through the purchase of something as simple as a milkshake, the actual answers are more nuanced than you might expect. Spoiler: the top two milkshake motives are not product-related (i.e. to satisfy hunger or to enjoy the taste). Instead, the number one job-to-be-done of a milkshake was to be a source of entertainment on a commute, and number two was to reward a child for good behaviour.

People ‘hire’ products and services to make progress in a certain circumstance in their lives (a ‘job to be done’).

So why would someone hire an online investing platform? What motivates people to invest themselves, outside, or in addition to, enlisting the help of a financial advisor. In Canada and the United States, roughly 15%-20% of the population has an online investing account. Many of these people have a financial advisor as well. More and more though, it feels like online trading has seeped into the culture, but the reasons why might not be immediately obvious.

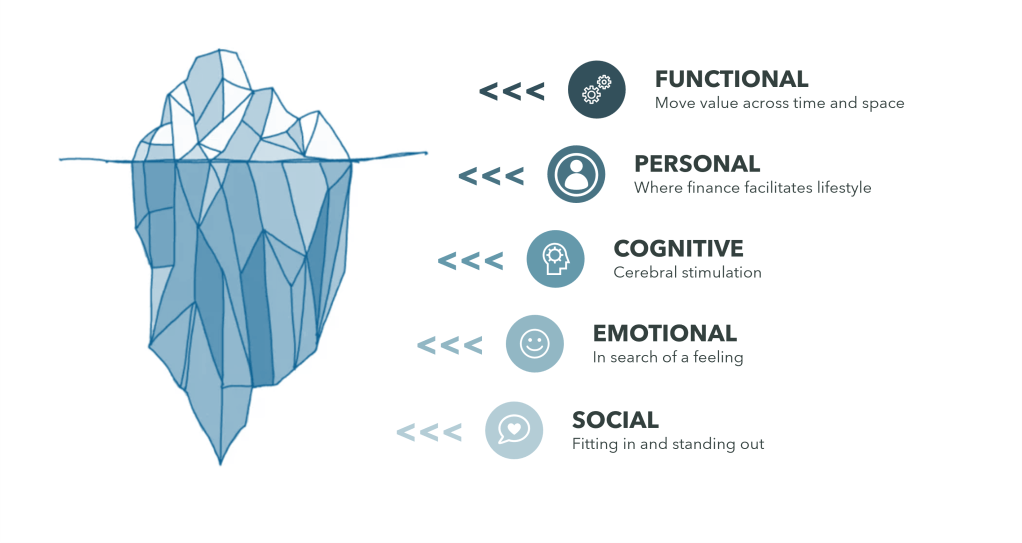

The following framework attempts to capture the top five jobs-to-be-done across five categories: functional, personal, cognitive, emotional and social.

Functional: To move value across time and space

Job 1 – Make a quick buck: It is no coincidence that when meme stocks trend in the news, more online investing accounts get opened. Some people invest purely with the short-term intention of turning one dollar into two. It is natural to want to partake with the crowd and the culture. But, instead of ‘make a quick buck’, more often, the outcome here is ‘lose a quick buck’. That’s not a bad thing. Investing can be a great teacher and some of its most valuable lessons cannot be learned without some skin in the game. However, this education comes at a cost, so ensuring that people are not overextended can keep the price of this school-of-hard-knocks investing degree within reason.

Job 2 – Build wealth over time: The traditional do-it-yourselfer or self-directed investor who manages all, or a portion, of their financial assets themselves typically does so to grow their wealth over time. That might be oriented around something common like reaching a financial goal or something more off-the-beaten path like maintaining purchasing power in the fight against the hidden scourge of inflation. In any case, this might be the most obvious, common and straightforward reason to invest.

Job 3 – Generate income: When you retire, you switch from accumulating assets to living off of those that you’ve accumulated. This shift in function and mentality changes people’s main focus from growth to income. Treasury bills, dividend portfolios and vexingly complex annuities become their new opportunity set. The goal becomes yield instead of gains, which is the core function that people seek when they invest for this reason.

Job 4 – Protect wealth: Some people invest to play offense and build wealth over time, some people invest to play defence and make protection their overarching goal. But protection from what? From market volatility? From inflation? From a decline in lifestyle? To keep a legacy intact? There are a million different categories of risk associated with people’s relationship with money. Investing to protect against some of those risks can often be a primary motivation driving someone to want to have a say in managing their wealth.

Job 5 – Diversify/reduce risk: Can you score goals while also playing defence? That’s what diversification provides: an opportunity to optimize returns (offence) per unit of risk (defence). People might not always explicitly state diversification as their goal and the form factor might not always be through their portfolio. I know a couple with four financial advisors because they want to protect against the risk of any single one of them having poor performance. Similarly, some people might invest online to complement a financial advice relationship as a method of diversifying their financial flexibility or the decision rights over their investment opportunities. We diversify for different reasons, but online investing can serve that functional role in many scenarios.

Personal: Where finance facilitates lifestyle

Job 6 – Education: Yes, education is an investment in itself (in building human capital). But with the price of a four-year degree continuing to outpace the rate of general inflation by over 10% per year (that is, since 2010), it also requires a large sum of money. Growing up, many of my teenage friends set aside their summer job income to support their education. Commonly though, our parents are the ones who invest for our futures and many set aside funds explicitly earmarked for college tuition. The 16+ million 529 accounts in the U.S. and 3+ million of RESP accounts in Canada offer solid proof.

Job 7 – Homeownership: In addition to RESPs, the Canadian government also introduced a tax-advantaged savings plan called the First Home Savings Account (FHSA) last year. Like education, the price of a single-family home has also well outpaced the rate of inflation over the past decade. National Bank publishes a quarterly Housing Affordability Monitor which says, as at Q3 2023, it would take the average Canadian over 6 years to save up for an average minimum downpayment. Those who live in Toronto and Vancouver are not as lucky where the numbers are 25 years and 29 years, respectively. This is a goal that requires saving and is increasingly a driver for why people invest.

Job 8 – Retirement: The bread-and-butter of the wealth management business, retirement presents the most common life-based event that investing helps to facilitate. Industry trends have also increasingly placed this burden into the hands of the individual. Gone are the days of generous defined benefit pension plans and other work-related or social saving options. Today, it is mostly up to the individual to adequately plan ahead to ensure their future self will be taken care of.

Job 9 – Legacy: Sometimes we are not investing for ourselves, but rather, for the next generation. This is not just for the fortunate few who have amassed generational wealth and want to ensure their families are well taken care of long after they are gone. This is also for regular joes who may just want to ensure they can contribute to things like their grandson’s education or their children’s financial security. Sometimes it’s not just about us. Sometimes we invest for others.

Job 10 – Major purchases or conspicuous consumption: Investing may also be a ticket to reaching financial goals other than retirement, education, or a first home. Weddings, renovations, cars, vacations: all good reasons to invest. Some may even take it a step further and invest with the objective of financing many or all of their purchases. For example, trust fund babies who live off the income generated by their portfolios may invest to maintain a lavish lifestyle more so than anything else.

Cognitive: Cerebral stimulation

Job 11 – Intellectual satisfaction: the markets are a puzzle that needs to be solved. We all love a good brain teaser and there is nothing that will tease your brain more than investing. Coming up with an investment thesis is much like the process of assembling a jigsaw puzzle, although not only is the picture of what you’re building hidden from view, the pieces you need are also scattered amongst a thousand others that look almost exactly like it. For those that love a good intellectual challenge, the puzzle of the markets is perfect for scratching that analytical itch.

Job 12 – Entertainment: the markets are a story that likes to be read. Some of the best stories of our time are the ones that contain the most relatable human elements like drama, excitement, fear, anger, humour, and greed. Turn on CNBC, and you will also likely get a heavy dose of each of those as well. Every company has a narrative that can draw you in. CNBC provides a preview, much like a book jacket. For those that want the full narrative, they can ‘buy the book’ by investing in the company where they can watch all of those entertaining human elements unfold in real-time.

Job 13 – Thrill: the markets are an adventure to be conquered. When Jim Simons, mathematician and founder at the hedge fund Renaissance Technologies, set out to on his quest to beat the market, he did so by looking at the markets as a math problem. It was a challenge to be overcome and it would take a long and winding road to get there. People who invested in GameStop would have a similar story to tell. They set out on a journey to vanquish an enemy in the hedge fund managers who tried to short the stock. As video game enthusiasts know, the allure of quest can be captivating. Investing can also be a quest, one where the investor is the main character with a variety of obstacles to overcome.

Job 14 – Compete: the markets are an arena to battle against others. In the stock market, there is a buyer for every seller. After all, that is the primary function of the market: to match willing buyers with willing sellers at an agreed upon price. In that light, markets are a zero-sum game. For every winner, there is also a loser. For everyone who bought TSLA stock in 2019 or Amazon stock in 1998, there are people who sold it. Markets are a competition and people who like to chase the feeling of ‘winning’ can be drawn into investing in pursuit of the sweet smell of victory.

Job 15 – Curiosity/Education: the markets are a school where learning is the goal. It wasn’t until my university days that I realized one of the primary reasons I adored the world of finance was because it was a forcing function to learn about the world around me. If you want to understand why Apple stock went up or down, you must have a grasp on everything from the ins-and-outs of the economy, the financial state of the consumer, monetary policy, technology trends, social trends, a read on U.S.-China geopolitical tensions… the list goes on. Participating in markets force you to learn. For those that enjoy it, there is no better reason to invest.

Emotional: In search of a feeling

Job 16 – Hope and dreaming: Is purchasing a lottery ticket a stupid financial decision? Those who operate on pure logic would tell you that based on your odds of winning and the expected payout, yes, it is! But those who operate on emotion, who see the value created through the hope that the lottery ticket fills its holder with or the fun that they have dreaming about ‘what could be’, they might tell you otherwise. The value in the lottery ticket is not the financial payoff, it is the emotional payoff, and investing can be the same way.

Job 17 – Safety and peace of mind: Our personality, values, set of experiences, genetics, and the culture around us all act to influence how willing we are to trust in others. Some people are incredibly trusting of strangers, perhaps to a fault where they are occasionally taken advantage of. Others fall on the other end of the spectrum, living in a cloud of skepticism where they prefer to be heavily self-reliant. Those who seek safety and find peace of mind in having control and decision rights over their assets may also be drawn to invest on their own.

Job 18 – The pursuit of happiness: More money, more problems. While that phrase might hold some truth, so to does the idea that money can buy happiness. Well, at least for those who fall into lower income brackets. Foundational work published in 2010 from Princeton University’s Daniel Kahneman and Angus Deaton had found that day-to-day happiness rose as annual income increased, but above $75,000 it leveled off. Of course, career and income growth is one path to a ‘happier life’, but there is a perception that investing can offer the same path as well.

Job 19 – Confidence and accomplishment: Personal growth is a motivator as old as time. After all, self-actualization is at the top of Maslow’s hierarchy of needs. To the extent someone views finance as something that they want to be good at, there is no better way to make progress against that objective than to be a self-directed investor. The path to financial confidence and accomplishment is often paved through lived experience.

Job 20 – Independence and self-sufficiency: If the feeling of freedom could be bottled and sold, I bet a lot of investors would be avid purchasers. Whether rightly or wrongly, chasing the idea of creating a self-sufficient source of income has a certain draw in today’s entrepreneurially-minded world. From old school day traders to the passive income + four-hour work week crowd, investing can offer people a step toward more autonomy.

Social: Fitting in or standing out

Job 21 – FOMO and participating in culture: Jared Dillian had a great line in one of his recently published Substack articles: A lot of people think that the markets oscillate between fear and greed—not really. Greed is just another form of fear, the fear of missing out, the fear that you’re not going to make as much money as someone else. It is also a story as old as markets. Keeping up with the Joneses is a primal motivator. People don’t evaluate ‘how they are doing’ on an absolute basis, they do so relative to their peers. Investing due to FOMO is all about alleviating the fear of being left behind. Perhaps it is not the smartest reason to invest, but it is one of the most human.

Job 22 – Community belonging: Say what you want about crypto, but one thing it has clearly demonstrated over the past few years is that a financial asset can serve a variety of purposes beyond just being held as an investment. Crypto is a microcosm of communities that have spun up around each protocol, project and application. It is communities all the way down. The traditional investing world is also like this. Investment tribes, as I’ve dubbed them in this article, form around specific investment theses. They meet to discuss cannabis stocks or AI companies or whatever the latest flavour of the day is. Being part of these communities has a certain draw where like-minded people find common ground, which meets one of our core human needs: to belong.

Job 23 – Supporting a favorite company or brand: The old phrase ‘invest in what you know’ is common financial advice and people who are avid fans of specific companies may find a path to supporting those brands through their investment portfolios. While this might counter the well-known benefits of diversification, tell that to the people who invested in a brand that they love like Tesla, Netflix or Apple. Using the latter as an example, in 2008, you could have purchased the freshly launched iPhone for $499, or you could have purchased the equivalent amount in AAPL stock (a split-adjusted $3.00 at the time) which would now be worth roughly $33,000. While this is the shining example, perhaps there is some sound logic to supporting your favorite brands through your investment portfolio after all.

Job 24 – Identity expression (status + recognition): What does your bank account say about who you are? What about your portfolio? For those with big bank accounts and healthy portfolios, investment options multiply. Some of those options, from fine art to hot hedge funds, are accessible only to the elite few, which is part of the appeal. Is your portfolio cocktail party conversation fodder? For some, that is one of the primary jobs-to-be-done.

Job 25 – Contributing to positive social change: Your portfolio can say many things about you, of which, status and recognition are a small subset. Portfolios can be social signalling vehicles for other messages as well. Perhaps you want to align your investment holdings with your personal values or what you think is best for society in the long run. Investment choices can be a powerful signal to others that you’re truly walking-the-walk instead of just talking-the-talk. But those signals can also be directed internally. The ‘feel good’ emotion that comes from trying to affect social change through your investment choices is yet another reason people like to invest.

Flipping the Iceberg

I love the jobs-to-be-done framework because it is such a straightforward way of pulling non-obvious insights out of things that seem so obvious on the surface.

As an industry, financial services does a good job of building and positioning value propositions around the functional elements of products. Some of the more progressive firms have taken a more human-centric approach, building and positioning around the personal level where finances can be connected back to the lifestyle factors they enable. But these are only the tip of the iceberg.

Beyond the visible surface, rarely do I see conversation in the industry around the cognitive, social and emotional jobs that investing can be ‘hired’ to fulfill. That’s not to say there are not small sub-cultures who discuss these things at the edges, but it is certainly not in the mainstream line of thinking (and is perhaps where some strategic alpha might be hiding).

I’d also argue this is where the green shoots of innovation will come from in an industry that is clearly in the maturity phase of its lifecycle where most product features, pricing and positioning factors have gravitated toward the same things.

To paraphrase what Rory Sutherland might say here, we have exhausted the rational innovation paths the industry can take around the functional and personal aspects of finance. Most of the innovation in the future will be psychological innovation, where instead of focusing on function and logic, we’ll instead focus on the cognitive, social and emotional factors where we can use some Alchemy to transform the mundane aspects of a mature industry into something a little more magical.

2 responses to “The Top 25 Jobs-to-Be-Done in Retail Investing”

[…] is also key product development. The last Paper & Blocks post covered the most prominent jobs-to-be-done for retail investors. Here are the TLDR big […]

LikeLike

[…] are often tangible items like the Tesla Model 3 or Apple iPad already mentioned. But, as has been written about already here, an investment portfolio can also be a signaling vehicle. This is why things like the Byzantine […]

LikeLike