We’ve all come across a similar story: one day Bob was fumbling around Twitter and bought an esoteric NFT. The next thing you know, Bob is a millionaire.

If you’ve spent any time on crypto twitter, you know that a number of crypto millionaires have been minted since digital assets broke onto the scene over a decade ago.

There are the OG bitcoin whales, who were both early and right on their investment thesis and have managed to hold on to their bags through the market’s severe ups-and-downs.

There are the DeFi degens who caught the DeFi summer wave and ‘yield farmed’ and ‘liquidity mined’ their way into a substantial portfolio of staked, loaned and borrowed assets.

Then there are the avante-garde NFT collectors, who found projects and communities that resonated with their interests and built ‘collections’ of one-of-one assets ranging from artistic works to digital real estate.

With all of these crypto millionaires emerging… what happens when they seek financial advice? Sure, many of them are self-directed or defer to the latest on TikTok for guidance. But what happens when they want good old fashioned financial advice, like the type they would get if they walked to their nearest bank branch or neighbourhood wealth management company and asked to have their portfolios reviewed and managed? Can these two worlds be bridged?

This scenario is going to be more common in the years ahead. Not just driven out of crypto, but driven out of the broader fintech trend of financialization.

Financialization Churns the Conveyor Belt of Finance

Liquid, legible, accessible, tradable: give an asset those characteristics, and you have a path toward financialization, which is the process by which a non-financial asset takes on the traits of a financial asset.

Fine art was once hard to participate in as an asset class. That is, until Masterworks came along and fractionalized high value artworks into small shares, enhancing liquidity, legibility and accessibility which helped to financialize the asset class in the process.

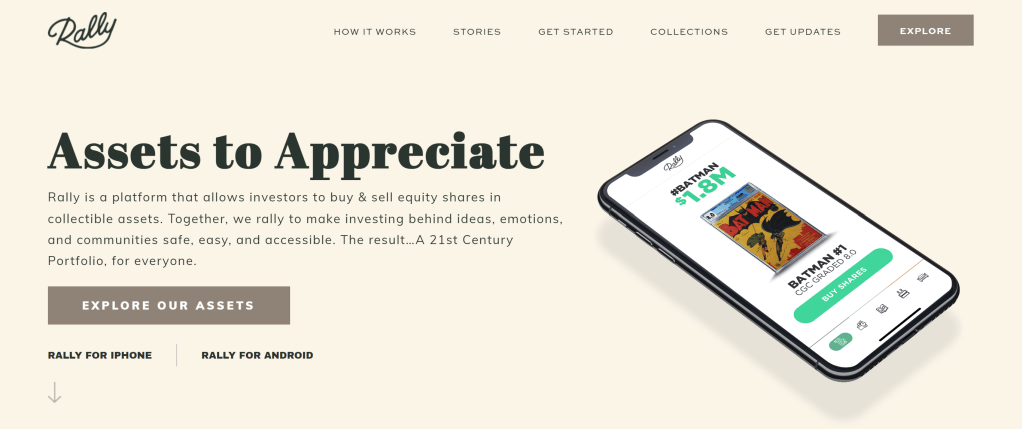

Collectible cars were once an investment made only by hobbyists and enthusiasts. That is, until Rally came along and created a process to turn individual cars into ‘companies’ that could be divided up into individual shares and sold to [and traded by] the public. These shares add financial characteristics to cars, a definitively non-financial asset.

Bitcoin itself, was also financialized. Existing first as a pure commodity/currency, bitcoin’s liquidity has been enhanced by the presence of trading venues, its legibility enhanced through consolidated price feeds, and its tradability enhanced by the introduction of derivative instruments like futures and options.

DeFi itself, is a financialization machine. Any asset that can be tokenized and brought on-chain can be introduced into the DeFi machine which makes them more liquid and fungible. That is, assuming they can be listed on a DEX, put up as collateral for a loan, or embraced by permissionless derivative protocols. (For a great take on tokenization, read: Tokens and The Future of Assets).

These fintech financialization forces are what make the conveyor belt of finance churn, transporting asset classes through a maturity cycle from emerging to traditional.

The Edge of Advice

Now, back to thinking about financial advice. If I walk into my advisor’s office today and have a portfolio of art, cars, NFTs and crypto assets (like any good Gen Z investor would), would they know what the risk-return profile of each of these assets is? How about the correlations between them? Would they know the tax implications of any transactions made? How about storage and custody solutions? Would they know individual nuances, like the fact that most crypto portfolios being held for the long-term have numerous paths (from staking to liquidity provision) to turn those static assets into yield bearing assets? Would they understand assets can have utility outside the investment return, like providing access to a specific community?

This is miles from the steady comfort of advising on 60/40 portfolios.

How are they to respond?

Well in theory, they should respond to this situation like any other portfolio of assets.

The principles of finance and financial advice remain the same.

Investment goals should still be lined up against personal goals; diversification is still a free lunch; and, modern portfolio theory can still help maximize return through a given level of risk.

While the principles of finance remain the same, the assets are what is changing.

Fintech brings to the masses what was once only available to institutions.

Real assets are being financialized (from Yield Street to Cadre, look at all the fractional real estate platforms that have popped up).

Creative works are being financialized (wow, Bieber pulled in $200 million by selling his song catalog as a financial asset).

As mentioned, digital assets are natively financialized.

Even people are being financialized. You can bet on someone by funding their ISA (Income Sharing Agreement) or by purchasing their friend.tech key.

With so many new types of assets coming on the scene, keeping on the leading edge of advice isn’t about inventing new principles or ways to manage assets… it’s about keeping up with the change in financial assets themselves.

What Does This Mean for the Financial Services Industry?

Luckily, the financial advice industry is potentially well positioned to handle this.

The most common service model in the financial advice industry is to be a financial generalist. Someone with above average financial knowledge who can deliver general advice that will apply in most situations. These generalists tend to cover the bases: financial planning, investment advice, estate/tax planning and insurance needs analysis—all of which are well established disciplines that have a standard set of best practices for generalists to follow. Generalist advisors are typically a good fit to serve a generalist population, and in a world where financial advisors determine their clientele based on geographic location (ie. setting up shop downtown or in a specific neighbourhood), this was the perfect model.

Interestingly, one of the ways the global pandemic of 2020 subtly rocked the financial advice industry was by encouraging pandemic-induced specialization. By forcing clients and advisors to meet remotely, the geographic link between client-and-advisor was broken. Suddenly, advisors were no longer constrained to competing against other local advisors in their geographic region. A client (or prospect) no longer had to be in the same neighbourhood as their advisor, let alone the same city. This subtle shift in competitive dynamic is an important one because it pushes the industry down the path of specialization.

If generalists in one locale are suddenly forced to compete with generalists in another, then no upper hand can be gained other than saying I’m just down the street so let’s go grab lunch or play a round of golf (although it should be recognized that the trust, relationship and human elements of financial advice are enormous). In this world, specialization becomes the path to differentiation and so advisors who can take aim at clients with unique circumstances or focus on a specific niche are the ones who will be able to compete most effectively for business when the playing field is increasingly remote-first.

Fortunately, financialization creates an explosion of new niches to specialize in. Advisors who intimately know the language, financial characteristics and tax treatment of NFTs may develop a unique set of knowledge and reputation in that space. Those who know the intricacies of royalty or advertising contracts may well want to focus their attention on building a practice serving creators to help them monetize (or financialize) their IP. The examples are endless. As long as the conveyor belt of finance keeps on moving, there will be new niches to serve.

Keeping Up With Financialization

So back to the question: could a typical generalist financial advisor advise a crypto millionaire on what to do with their money?

How about a creator whose income is purely derived from their creative works?

Do these people even speak the same language?

Perhaps, or perhaps not. They certainly already have the right knowledge, approach and principles to offer sound financial advice, but may lack the domain knowledge required to adapt to a fintech landscape that is changing faster than ever.

More academic theory about how to manage a portfolio is not required, but more education and motivation to look at the changing landscape of financial assets is.

Financialization means people’s personal portfolios may start being comprised of more than just stocks and bonds. For now, it will be up to those targeting specific niches to fill the void. But what is niche today, eventually becomes mainstream tomorrow. To compete, means to keep up with the edge of advice.