-

Youth Leads Culture: Why Understanding Generation Z is Imperative for Any Business

“When you’re young, every rule is illegitimate until proven otherwise. It is precisely because [youth] have so little to lose from the way things are that young people will continue to be the inexhaustibly neophilic motor of culture.” I love this quote from Derek Thompson’s book Hit Makers because it rings so true. Young people…

-

Open Beats Closed: Why Crypto Deserves Our Attention

What do someone from a large money center bank, a small local credit union, a mid-sized RIA, a fixed-income trading desk, and a payment services provider have in common? Well, it is the same thing everyone in finance has in common: they should be paying attention to crypto. Perhaps it is not at the top…

-

Validated Learning in Strategy: Bringing Lean-Startup Thinking to the Corporate Strategy World

Minimum viable products… MVPs were all the rage back in 2012 when we first started exploring the fintech arena at the consultancy I worked at. Eric Ries had just published his book and validated learning was being discussed in the offices of both corporations and startups alike. The framework was elegant. Build-measure-learn: a concise feedback…

-

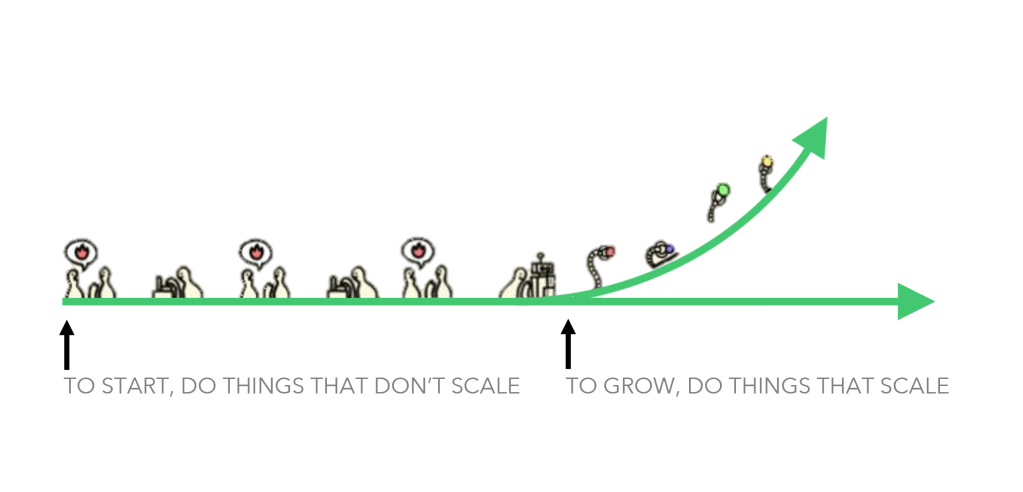

Unlocking Dormant Supply and The Strategy of Doing Things That Don’t Scale: The Case Study of Canada’s Neo Financial

“Do things that don’t scale”. This common advice, often bestowed upon start-up founders—particularly those going through Y Combinator—was popularized by Paul Graham in a 2013 blog post. The crux of his argument was that a start-up’s biggest advantage is its speed and ability to adapt and what better way to learn what customers want then…

-

Financialization and the Edge of Financial Advice: Keeping Pace in a Fintech-forward World

We’ve all come across a similar story: one day Bob was fumbling around Twitter and bought an esoteric NFT. The next thing you know, Bob is a millionaire. If you’ve spent any time on crypto twitter, you know that a number of crypto millionaires have been minted since digital assets broke onto the scene over…

-

Revenue Mirages: When to Ditch an Ephemeral Revenue Line

Last week, Lyft reported their second quarter earnings, and the release contained an interesting nugget about their future pricing plans. As per TechCrunch: Lyft’s revenue per rider decreased almost 5% quarter-over-quarter, while the number of active riders increased in the second quarter to 21,487 riders, up from 19,552 in the first quarter. Lyft appears to…

-

Where There is Dislocation, There is Opportunity

In financial markets, when asset prices get pushed off their natural state of equilibrium for an extended period of time, this state is known as a ‘dislocation’. Looking back, the panic that set-in on March 2020 after we collectively realized a pandemic was upon us produced a dislocation across capital markets. The shutdown of supply…

-

Pricing the Most Perplexing Type of Asset: Human Capital

Price discovery: it is an important attribute of well functioning capital markets. Some markets trade with relative ferocity and liquidity with heavily engaged participants actively trying to squeeze the best price out of the market. After the bell rung to close out the trading day last Friday, 122+ million shares of Tesla’s stock ($TSLA) had…

-

The New Focal Point: How Brands Become More Valuable in the Age of Generative AI

The Cost of Distribution Goes to Zero Here’s a problem very few people have had in recent years: newspaper ink stains. Pouring through the Sunday Times inevitably meant having to wash a thin black film off of your fingertips… but when was the last time you held a physical newspaper in your hand long enough…

-

Reducing the Time to Asymptote: A Framework for Thinking About the Ingredients of Scale

We’ve all seen this chart before. It is an illustration of how technology adoption has accelerated over the past 100 years. The standard telephone took over 60 years to reach 80% adoption amongst U.S. households. Cellphones reached the same milestone, but took only 20 years. Some of these technologies will peak at ~100% adoption among…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.