In what scenario would you spend $100 to acquire a freshly minted $50 bill?

… there probably aren’t many.

How about with a slight twist: In what scenario would you spend $100 to acquire $57 worth of Bitcoin?

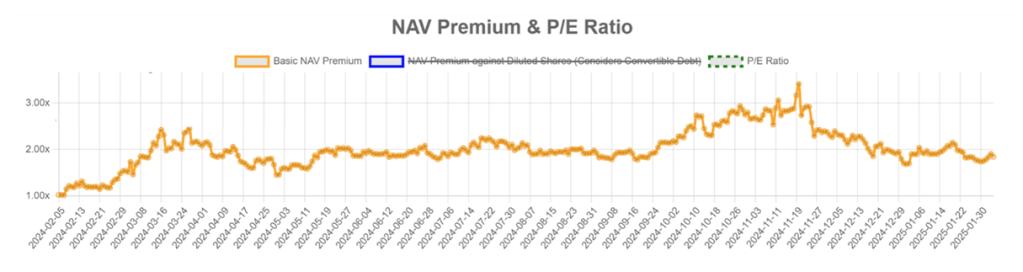

… in the open market, you likely won’t find this situation. But for the shareholders of MicroStrategy ($MSTR), a company whose equity value of $84 billion backs its Bitcoin Treasury Reserve worth $48 billion, that’s exactly what new shareholders are doing.

Now, buying Bitcoin for 57 cents on the dollar might not seem like a good deal (why wouldn’t you just invest directly in Bitcoin or in an ETF that almost perfectly approximates its price movements). So why do investors seem to think it is?

Well, for the same reason that any company’s equity would trade at a premium to its net asset value (NAV): the promise of future growth.

In this case, investors are making the bet that the amount of Bitcoin they own per share will grow at a rate that will eventually see it exceed the discount-to-NAV they made the initial purchase at.

For example, if I bought $100 of $MSTR today and it acted as a proxy to a claim on $57 of its Bitcoin treasury reserve (which would be 0.000542 Bitcoin), my bet as a shareholder is that Michael Saylor & Co. will be able to grow that 0.000542 Bitcoin over time to eventually exceed the 0.000962 Bitcoin that my $100 could have purchased on the open market instead.

The $MSTR team fondly refers to this metric as a “BTC Yield” or the increase in Bitcoin ownership per share. In our example, I would need a BTC Yield of 77% (eg. 0.000962 ÷ 0.000542 – 1) to justify buying $MSTR stock at a premium to its NAV, which sounds like a hefty return.

A 77% return on any stock in the market would be a huge gain, let alone, 77% in Bitcoin terms. This doesn’t sound like a good deal for the investor… until you consider the fact that $MSTR produced a 74.3% BTC Yield in FY 2024 alone and doesn’t appear to be slowing down their capital markets activities anytime soon.

MicroStrategy Raises $563 Million From Preferred Stock Sale to help finance its purchase of more Bitcoin. https://finance.yahoo.com/news/microstrategy-raises-563-million-preferred-131720666.html

$MSTR’s disciples have also delivered similar results for their shareholders. Japan’s leading Bitcoin Treasury Company, MetaPlanet, achieved an incredible 309.82% BTC Yield in Q4 2024 alone and also appears to be ramping up their activities:

MetaPlanet Announces 2025-2026 Bitcoin Plan and outlines a bold strategy to accumulate 10,000 Bitcoin by the end of 2025, and 21,000 Bitcoin by the end of 2026. https://metaplanet.jp/press-release/bitcoin-plan/

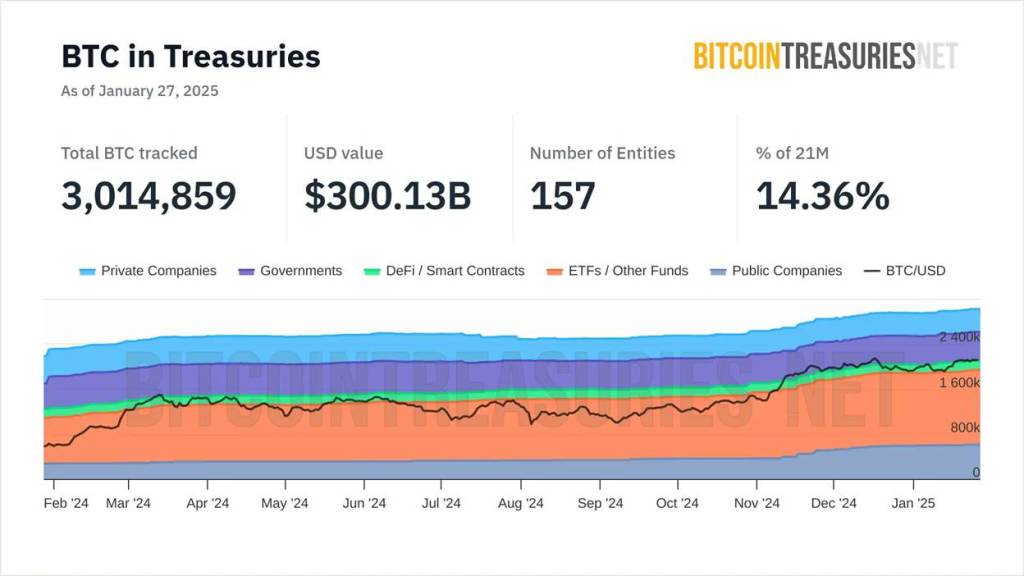

BTC Yield is the reason investors seem to be betting on Bitcoin Treasury Companies instead of simply using ETFs – and the strategy is starting to expand. In fact, the number of Bitcoin Treasury companies exploded in 2024. Bitcointreasuries.net now counts 157 firms holding BTC on their balance sheets.

The Canadian Disciple

There are a variety of Canadian companies that have embraced the Bitcoin Treasury Model as well, but only one that stands alone as the OG bitcoin pure play: a BC-based firm called LQWD Technologies.

LQWD describes its mission as enhancing shareholder value through its innovative Bitcoin accumulation strategy and scalable yield-generating opportunities through the Company’s Lightning Network operations.

The company proudly boasts its version of the BTC Yield metric that they term ‘sats per share’ (a ‘sat’ or ‘satoshi’ is the smallest denomination of BTC or 0.00000001 of a token).

At a $45M (CAD) market cap and with $24M (CAD) Bitcoin on its balance sheet, the company humbly trades on the TSX Venture Exchange at an 88% premium-to-NAV as of the date of this post (January 2025), almost mirroring the premium of $MSTR.

The company also has not been shy about converting some of that premium into sats-per-share as it raises funds through private placements:

And that capital markets activity is leading to an increase in Bitcoin purchases:

But where this little Canadian company gets interesting is not in the conversion of its premium-to-NAV into sats (which is a proven strategy), but rather in what it does to bolster its sats-per-share metric even further.

Yield Envy Calls for Creativity

Ever since the ‘merge’ when Ethereum officially jumped chains and switched from proof-of-work consensus over to proof-of-stake, the Bitcoin world has had a little case of ‘yield envy’ (although most people in that world probably won’t admit it). Bitcoin has become one of the last few standing proof-of-work chains, and hence, lacks a staking mechanism to generate yield like Ethereum, Solana and pretty much every other major chain that was born post-2015.

So, if you were to ask someone in the Bitcoin space how to turn their BTC into a yield-bearing asset, here are some of the suggestions you might get back:

- Lend it: Platforms like Ledn, Nexo, and CoinLoan allow you to lend out your BTC to institutional borrowers in exchange for interest… but this exposes you to counterparty risk.

- DeFi it: Platforms like Aave or Compound (via wrapped Bitcoin, wBTC) enable BTC lending and borrowing… but this comes with smart contract + liquidation risk.

- Farm it: Platforms like Uniswap, Curve, or PancakeSwap (for wBTC pairs) allow you to provide wBTC liquidity in trading pairs (e.g., wBTC/ETH, wBTC/USDC) and earn trading fees + potential governance token rewards… but this also exposes you to smart contract + liquidation risk.

- Synthetically stake it: While BTC itself is not a proof-of-stake asset, you can use synthetic products like Stacks (STX) or Bitcoin-backed tokens on platforms like Stacks or Sovryn to earn yield… but this comes along with, you guessed it, smart contract risk and idiosyncratic/technical protocol risks.

- Go ‘old school risk manager’ on it: Writing covered calls (selling call options against your BTC) can generate yield… but this caps the upside potential and risks having your assets called away.

And that leaves one more option:

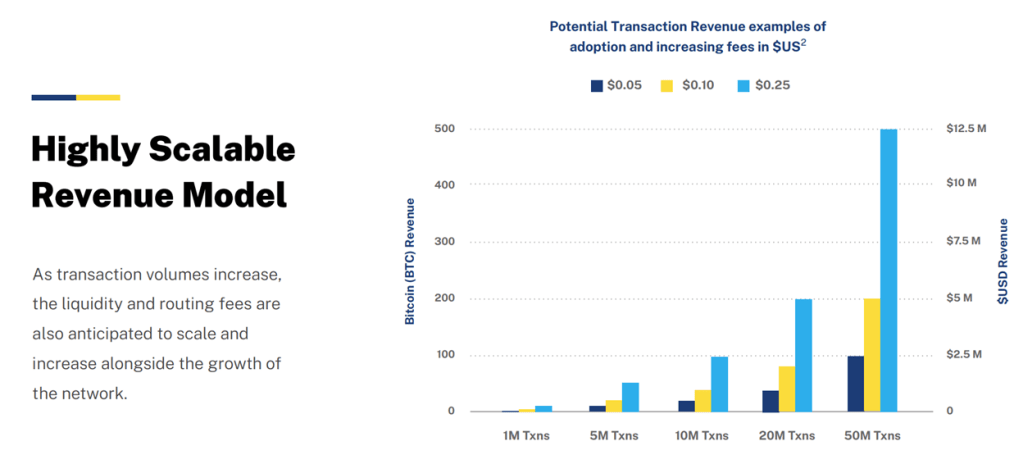

- Channel it: Run a Bitcoin Lightning Node (ie. open up a Lightning Network payment channel and earn fees for routing transactions). This is the path that LQWD is pursing. In fact, here is the cover slide for their most recent Investor Presentation.

The Power of Lightning

A quick primer: The Lightning Network represents a layer 2 payment infrastructure constructed atop the Bitcoin blockchain, which facilitates nearly instantaneous payments with high scalability. It has the capability to process millions of transactions per second, at a fraction of the cost of traditional payment rails.

Use cases vary from the innovative to the mundane, and include things like:

- Retail Payments – Businesses like Starbucks (via Strike) and other merchants have started accepting Lightning payments.

- Remittances – Lightning makes Bitcoin a faster and cheaper alternative to traditional remittance services.

- Streaming Payments & Micropayments – This allows for tiny or real-time payments for content, subscriptions and pay-as-you-go services.

- Machine-to-Machine (M2M) Payments – Enabling instant, automated microtransactions between connected entities or devices plays into the quickly expanding AI agent ecosystem along with the internet of things.

- There is also growing interest in bringing stablecoins (like Tether/USDT) onto Lightning

The network itself is built atop a web of interconnected payment channels that individuals or node operators can open up by funding the channel with Bitcoin. Routing Nodes, who are central hubs in this Lightning Network web, handle higher throughput and earn fees for routing payments for others. This involves keeping a node online 24/7, maintaining its liquidity, opening up channels with other high-volume nodes, and setting dynamic fees to optimize revenue.

Running a Routing Node requires capital (ie. Bitcoin) that is then used to open up payment channels (effectively, ‘committing’ it in order to facilitate the network’s payments). Liquidity management, channel rebalancing, optimizing peer node channels, monitoring routing activity, fee optimization, and ensuring uptime and security are maximized are all additional key success factors for firms operating these services.

These are all capabilities that the LQwD team has built over time as well to integrate Lightning as a key component to their strategy to grow sats-per-share. The firm leverages its Bitcoin to generate additional yield for shareholders by deploying it on its Lightning Network infrastructure.

Today, Lightning fees are not a material source of sats (see the latest financials here). That said, the opportunity for LQwD is attached to scaling the Lightning Network (see the slide below from their investor deck):

To the extent the Lightning Network can attract payments activity and grow, LQwD will be well positioned to enhance the yield they can generate on the bitcoin they hold.

A Premium-to-NAV is a Gift

At the end-of-the-day, while Lightning may be the long-term sats-per-share strategy, the real gift to existing shareholders in the short-term is the premium-to-NAV.

It is what allows firms like LQwD or $MSTR to issue new shares through their equity/debt issuance and buy more Bitcoin with the proceeds (generating BTC Yield for those existing shareholders while often diluting their equity value at the same time – this often referred to as the oxymoronic term ‘accretive dilution’).

$MSTR has been the most innovative on this front. In addition to the genius of taking advantage of the stock’s volatility by issuing convertible debt (the more volatile the stock, the more favorable the terms on converts), their latest creative approach to the capital markets has involved the issuance of perpetual strike preferred stock (STRK). As long as the premium-to-NAV exists and the company can find buyers for its newly issued securities, it can continue to accretively dilute existing shareholders and produce for them what they came for: BTC Yield. This applies to other Bitcoin Treasury companies as well, including LQwD.

Premium-to-NAVs can also be fleeting. There is a need to strike while the iron is hot. But there is also a need to innovate, which is exactly what a foray into the yield generation potential of Bitcoin represents. LQwD has an interesting path ahead. I will be following with interest.

—

Disclaimer 1: The content of this blog is for informational purposes only and should not be considered financial advice or a recommendation to buy or sell any securities. The authors may hold positions in the securities discussed. Readers should conduct their own research or consult with a financial advisor before making any investment decisions.

Disclaimer 2: The author relied on publicly available information to write this post and did not interact with or have any communication with representatives of any of the companies mentioned.