The beautiful thing about the crypto industry is its compounding nature.

New ideas build upon old ideas thanks to the open-source ethos that is omnipresent in the space.

Copy + Paste + Improve.

That’s true for protocols themselves, where new assets improve upon old assets, new virtual machines (VMs) improve upon old VMs, and new applications improve upon (and sometimes vampire attack) their predecessors.

That’s also true for business models. In 2024, one business model grabbed the attention of the investing world more than any other: the Bitcoin treasury company. The most famous of which, MicroStrategy ($MSTR), recently topped $100B in market cap and just joined the NASDAQ 100 index.

MicroStrategy’s Playbook

No one explains MicroStrategy’s playbook better than their CEO Michael Saylor:

The TLDR: MicroStrategy has found what the media likes to call an ‘infinite money glitch’. The former software company has transformed itself into a Bitcoin acquisition company, which is their primary focus and shareholder value creation mechanism today. They drive the value of their stock price higher primarily through two financing paths that they follow to make their Bitcoin purchases:

- At-the-market (ATM) equity offerings which provide them with a way to issue shares into the open market at the current market price. Through this mechanism, MicroStrategy is diluting its existing shareholders to raise cash to buy more Bitcoin. However, thanks to the leverage built into the stock, today it trades at a premium. That allows the firm to issue new shares at a price much higher than the net asset value (NAV) of the Bitcoin on its books, effectively increasing the Bitcoin-per-share, or Bitcoin Yield, of their existing investors. They then rinse-and-repeat.

- Convertible bonds, which gives the firm a way to add leverage to their capital stack and raise money through the debt markets in order to buy more Bitcoin. Convertible bonds are effectively a bond issued with a long-dated call option (the convert feature). As the company is now a [very liquid] NASDAQ 100 constituent with a highly volatile stock (both factors that make options more valuable), the company is able to issue their convertible bonds at a 0% interest rate. Free money today to buy more Bitcoin for tomorrow.

These two primary capital raising paths give MicroStrategy something most other firms raising equity don’t have: ‘accretive dilution‘—a way to simultaneously dilute existing shareholders while increasing the value of their shares.

The result: MicroStrategy is up 455% over the past 12 months, far exceeding the 101% increase in Bitcoin

… and this outperformance has been going on for years.

Copy + Paste ?

Other firms have tried to Ctrl+C and Ctrl+V the MicroStrategy playbook, but the strength of $MSTR’s balance sheet, their existing cashflow generating software business, and the liquidity and volatility profile of their stock make it a difficult thing to replicate. In short, it can be done, but the company likely won’t be as successful as $MSTR and their shareholders will face a higher degree of risk unless they can solve for the above three aspects.

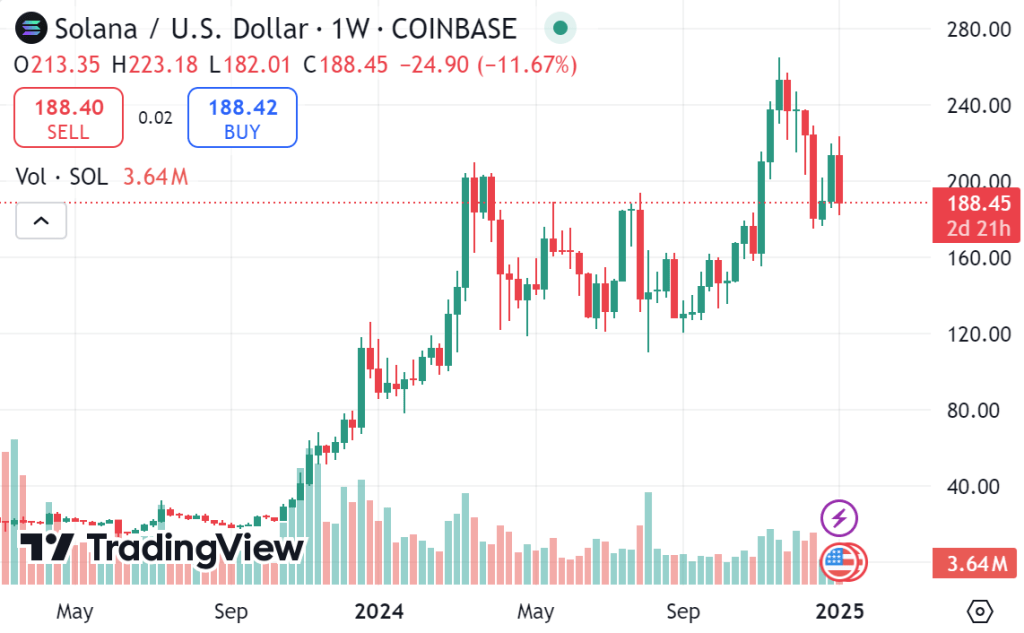

But perhaps instead of replication, there is an opportunity to find industry white space with other popular crypto assets. Enter: Solana and Sol Strategies.

Sol Strategies ($HODL)

From their latest press release, Sol Strategies is:

…a publicly traded Canadian company actively investing in, supporting, and providing infrastructure for the Solana blockchain and ecosystem. The Company focuses on leveraging investment opportunities in staking rewards and Solana-based projects, enabling shareholders to indirectly participate in the decentralized finance landscape. Sol Strategies is headquartered in Toronto, Canada, and is publicly listed on the Canadian Securities Exchange under the ticker “HODL” and on the OTC market under the ticker “CYFRF”.

Sol Strategies is a recently rebranded holding company whose primary aim is to support and invest in the Solana ecosystem. They do this in three primary ways:

#1 Investing directly in SOL which is the primary asset on their balance sheet. Today the company has 142,801 SOL and has recently tapped both equity markets and credit markets in order to grow that figure.

#2 Operating multiple validator networks. Following the company’s recent acquisition of Orangefin, Sol Strategies will have increased the staked SOL across its validator operations to 1,505,145 SOL. Those operations provide the business with predictable staking income and allow them to support the Solana ecosystem as an infrastructure provider.

#3 Investing in venture opportunities. Sol Strategies holds additional private equity and venture capital investments including Chia Network, Ngrave, and a prior investment in Animoca Brands. This has been suggested as another path through which the company can support the growth of the Solana ecosystem.

Yes, Sol Strategies sounds a lot like the ‘MicroStrategy of Solana’ –- and back in October 2024, it appeared the market started recognizing that as well

For more information on the company, check out CEO Leah Wald’s interview on the Lightspeed podcast:

Copy + Paste + Improve?

So, is Sol Strategies the ‘MicroStrategy of Solana’? Well, there are certainly some similarities.

Three recent headlines:

Sol Strategies Announces CAD $27.5 Million Private Placement with ParaFi Capital: raising capital (via Private Placement of convertible debentures – not an ATM equity offer like MicroStrategy) with the proceeds to be used to increase the Company’s SOL treasury holdings, for organic and inorganic expansion of its revenue-generating validator operations, as well as general working capital purposes.

Sol Strategies Announces Major Strategic Investment in Solana: CAD $25 Million Credit Facility To Be Deployed to Acquire Solana Tokens: tapping debt markets (via a revolving credit facility) with the intention of utilizing the proceeds for large-scale purchases of Solana tokens and support its other commitments to ecosystem growth.

Sol Strategies Applies For Listing on Nasdaq Exchange: moving off of the Canadian Securities Exchange and on to the NASDAQ is key to enhance institutional investor access and expand the company’s market presence.

The other thing that mirrors MicroStrategy: the stock currently trades at a large premium to NAV, which is a big part of what allows the infinite money glitch to persist.

That said, Sol Strategies is still early in their development. They do not have the same access to capital markets (although a NASDAQ listing will help) or an active options market on their stock – nor will they likely be able to negotiate as favorable of terms as Michael Saylor (see the convertible debenture deal above). But in addition to the ‘Copy + Paste’, the company has three other things going for it that separate it from others that act as holding vehicles for crypto assets and $MSTR.

Improvement #1 – Industry whitespace: there are no other publicly traded vehicles in North America that are set-up to provide direct investment exposure to Solana. Sol Strategies is finding a blue ocean by escaping the almost red (maybe call it, orange…) Bitcoin treasury company ocean. This may not last long, however, as according to this Cointelegraph article:

At least five companies are vying for a spot Solana ETF, including asset management giants VanEck, Grayscale, 21Shares, Bitwise and Canary Capital. The deadline for Grayscale’s Solana ETF application is Jan. 23, while the four other applicants expect a preliminary decision by Jan. 25, 45 days after the SEC formally accepted the ETF application for review in November 2024.

That said, there appear to be no other direct competitors vying to become the ‘MicroStrategy of Solana’, yet.

Improvement #2 – Staking and their validator operations: Something Solana (and most other proof-of-stake protocols) has that Bitcoin does not is the ability to generate yield via staking. The fact that Sol Strategies owns their own validator operations also means they have additional flexibility, margins and opportunities for growth. This is somewhat akin to the cashflows available to MicroStrategy via their software business, which comes in handy when raising debt and interest coverage.

Improvement #3 – A general mission to help grow and support the Solana ecosystem: It is hard to argue that other than Satoshi him/her/their self, no one has done more for Bitcoin than Michael Saylor. But MicroStrategy’s support is primarily via ‘number go up’. Sol Strategies seems to take that one step further by looking at other avenues—from their infrastructure to their venture/project investments—to support the Solana ecosystem.

Summary

Whitespace is never easy. It is incredibly difficult to carve a new path as a business. After doing this deep dive, I wanted to give some props to the Sol Strategies team for forging new ground and supporting arguably the most interesting and dynamic ecosystem in crypto today in Solana.

They indeed have all the ingredients to follow that crypto-native formula of Copy + Paste + Improve. Now it is time to execute. I will be following with interest.

—

Disclaimer 1: The content of this blog is for informational purposes only and should not be considered financial advice or a recommendation to buy or sell any securities. The authors may hold positions in the securities discussed. Readers should conduct their own research or consult with a financial advisor before making any investment decisions.

Disclaimer 2: The author relied on publicly available information to write this post and did not interact with or have any communication with representatives of any of the companies mentioned.