A few weeks ago, Fartcoin officially crossed the $1 billion market cap threshold. That either means the world has lost its mind, or something very interesting is going on under the hood in the innovation lab of Finance.

Before meme stocks burst onto the scene with the Gamestop short squeeze in January 2021, there were meme coins. The OG, Dogecoin, was created in December 2013 by software engineers Billy Markus and Jackson Palmer and was initially intended to be a parody of bitcoin and a commentary on the speculative ridiculousness of the crypto markets.

Just like Bitcoin (which some argue, is the original meme coin), meme coins have no intrinsic value. They represent an idea and as that idea spreads, the coin accrues more value. It is one of the purest versions of the ‘greater fool’ theory. The price of the token is derived from the willingness of others to buy it at a higher price. But people holding meme coins are no fools… In fact, most are laughing all the way to the bank (see the Fartcoin comment above). They are also the perfect illustration of why crypto is so interesting today.

Investing in ‘Ideas’

At the end of the day, what a memecoin allows you to do is invest in an ‘idea’. It could be:

- a joke (Fartcoin)

- an old meme (DOGE representing the old Shiba Inu meme)

- an emerging meme (CHILLGUY who started showing up all over TikTok over the past few months)

- a belief (SPX6900 whose holders believe the token’s value can ‘flip’ the value of the S&P 500 if enough people hold it)

- a story (GOAT as a representation of the lore of Goatseus Maximus)

- a business (PENGU as the community token for Pudgy Penguins)

But what meme coins represent is actually a true fintech success story.

As the fintech river has carved its path through the traditional financial services world, one of its primary distributaries has been to democratize access to financial services. In the investing space, this often meant making opportunities available to retail investors that were once only available to large institutions. The ETF democratized access to low-cost index exposure. Masterworks is democratizing access to fine art. Companies like iCapital and Obsiido are bring access to alternative strategies (hedge funds, private equity, etc.) to the masses. Cadre brings commercial real estate opportunities to everyday investors. etc. etc… you get the picture.

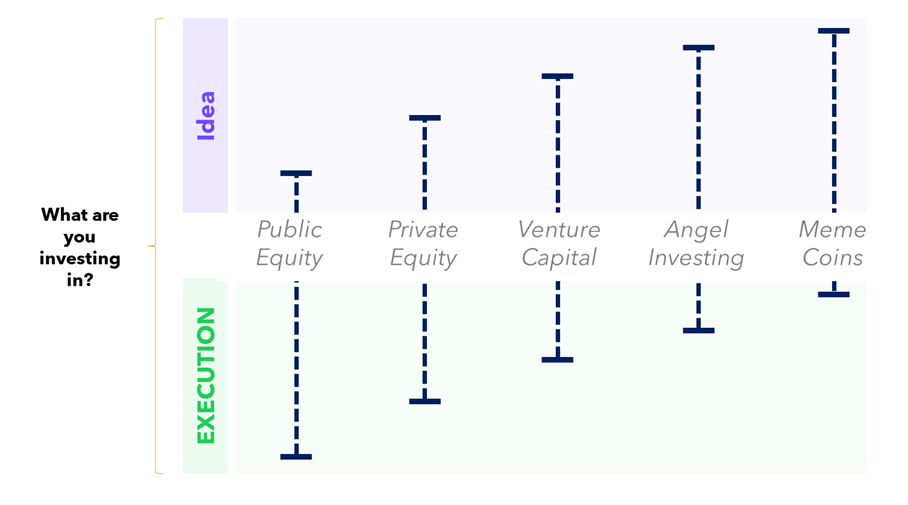

One of the throughlines of this democratization effort has been to get investors access to investment opportunities at an earlier stage in a company’s lifecycle. No longer are publicly traded equities the primary way to invest in companies. Select venture capital opportunities opened the door to earlier and earlier stage investments. Crowdfunding efforts and Angel Networks took this to the next level, allowing investors to get in when a business exists only as an ‘idea’ that has yet to be executed.

Meme coins push this idea further down the stack: the purest form of investing in an idea before any other commercial opportunity exists.

Many traditional investors would dismiss meme coins as pure speculative dust since no current or future cashflows sit underneath. But a token-based investment model does not necessarily require cashflows. Instead, value accrues to the token through scarcity and the promise of more holders.

For example, a recent project from the depths of the current crypto meta (AI) is Scoutly.gg. It is an AI-driven sports betting prediction app. They do not receive cashflow from paying customers per se, but instead, they ‘token gate’ access to their product. You must hold 15k $SCOUT to access the Basic level, 80k to access Pro services, and 400k to access the Premiere package. Using the service drives up the price of the token, but no direct payment for services is made.

Scoutly is an example of an app with utility. But some ‘ideas’ or memes have no utility. Does something like DOGE have a real-world impact or create commercial opportunities? Well, after the token was launched and a community of holders were formed, the opportunities started to pile up:

- Dogecoin became popular for small-scale tipping, rewarding creators or individuals on social platforms like Reddit and Twitter for their contributions.

- Dogecoin became a payment Option for Merchants: Companies like Tesla (limited merchandise), Newegg, and AMC Theatres have accepted Dogecoin as a form of payment for products and services.

- The Dogecoin community sponsored NASCAR driver Josh Wise in 2014, branding his car with the Shiba Inu image.

- The community raised $30,000 to help the Jamaican bobsled team attend the Winter Olympics.

- Over $30,000 was raised to fund a clean water project in Kenya through the Doge4Water initiative.

This is what meme coining is about. Find an idea that resonates, then form a community where everyone is tied together by the successful spread of the idea and the future promise of more holders.

The cashflow sticklers are indeed correct: meme coins are pure speculative dust with no cashflows underneath. But does that make them any less valid than an angel investment in a founding team with an idea and a dream and very little else?

The challenge with accruing value through a token based on the future promise of more holders is that if that promise fades, there is very little else to base value on. The sky is the limit for memecoins, but it is hard to argue the floor could be anything greater than zero.

The Token is the Product

Meme coins are not stocks. They do not represent a claim on business or any type of formal organization.

Nor are meme coins utility tokens, like ETH in Ethereum, where the token is required to transact on the network.

When it comes to meme coins, the token itself is the product.

When I say “the token is the product” I’m not being facetious — I actually believe that for anyone trying to build a valuable company in crypto, your first and primary goal should be to attract permanent attention and liquidity to your token, AKA to sell it to anyone who will hold it for a very very long time.

And if the token is the product, then it is supported by two key fundamental measures of success: attention + community.

Attention: For a meme coin to work, it has to attract attention. Attention is the lifeblood of a meme coin. Without it, the token shrivels towards its lower asymptote and dies. To attract attention, ultimately most meme coins align against a core job-to-be-done: make people money! Financial incentives are among the most powerful for organizing a community around a common goal. The prospect of getting rich by joining a movement is almost cult-like in its ideals, but it is the primary underpinning of meme coin activity today.

Community: There are also other factors that support these tokens: many of which stem from the social and emotional benefits being a part of a growing community. Below is Murad’s list of meme coin utility from his TOKEN2049 presentation:

- Having fun

- Loneliness reduction

- Identity, finding a similar crew

- Hope provisioning

- Friendships

- Being a part of cutting-edge culture

- Sense of belonging

- A guild in the MMORPG that is crypto

- Experience of teamwork

- Greater sense of participation and contribution

- Reliability + emotional connection

- Mission + meaning

- Entertaining + being happy

- Charity

- Collective artistic expression

- Collective imagined reality

- Collective storytelling and lore building

What comes next? Meme Coins with a Personality

Today, OG meme coin communities rely almost exclusively on supporters to generate attention and activity. But that might not be true for long.

The newest memes on the block now come with a personality thanks to the modern magic of LLMs. Right at the intersection of AI agents and crypto is an emerging meta: tokens with personalities.

A bespoke LLM created around a particular character or vibe could keep being inventive about its core idea, and keep pumping out content and interacting with its community in real time.

Take Dolos the bully, for example, who throws shade on X like no tomorrow and whose token is valued at a cool $55M.

Or maybe Degen Spartan, whose $60M market cap is supported by a 20k+ followers on X and a constant stream of slightly offensive commentary on what’s going on in the crypto market.

It’s unclear if there is value in being able to ask your favorite meme about what flavour of ice cream they prefer… but now the technology is in place to do so.

The ability to interact with meme coins also ups the ante on community engagement, helping to organize a previously fragmented group of supporters around a common conversation. The consequence: meme communities can band groups even closer together, transitioning them from a loosely connected community into a tight knit tribe.

Attention is the Aim, the Token is the Product, the Tribe is the Vehicle

So this is what investing in pure ideas looks like: it is all about attention and community.

Ultimately, meme coins are just another version of an investment tribe:

Given that investing is inherently social AND people have an instinctual need to belong to communities AND we have an explosion of online tools that can facilitate the formation and maintenance of tribes… Investment tribes are where people come together to be a part of a community of shared investment interests.

But from dogs to cats to farts to jokes, it is the ridiculousness of some of the ideas these tribes coalesce around is what seems absurd and out-of-the-norm… but hey, did those ideas grab your attention?

Then they probably did their job.