Question: where did the phrase “going down the rabbit hole” come from?

Answer: It goes all the way back to Lewis Carroll’s 1865 classic “Alice’s Adventures in Wonderland.” In the novel, Alice follows a white rabbit down a rabbit hole and finds herself in a fantastical and surreal place filled with peculiar characters, magical creatures, and whimsical landscapes.

That rabbit hole was a portal into a new world filled with things that did not seem possible on the other side.

This journey is exactly how a lot of finance professionals feel when they go down the crypto rabbit hole for the first time.

What… automated market makers, prediction markets, flash loans, perpetual futures, atomic swaps… If I didn’t know any better, I would think I had entered an alternate financial reality.

In a way, that is what crypto represents. It is the fantastical financial world on the other side of the rabbit hole, or the portal that we can call ‘web3 gateways’.

Web3 Gateways

To illustrate what a web3 gateway is, there is no better place to look than the industry leader: Coinbase.

If you have ever played around with the Web3 tab in Coinbase, you know it is not the app’s focal point, which is of course, buying and selling crypto through their custodial exchange. In fact, the Web3 tab is exactly that. Just another tab, but one where you can find all sorts of ‘imaginative’ services you may never have heard of. It certainly is not the center of the app today, but there is a chance that one day, it will be…

Coinbase’s Web3 tab is a ‘Web3 gateway’. It allows a customer to operate a non-custodial wallet to access the explosion of services being built in the on-chain world. Here, the alternative universe of fantastical financial services can be found alongside an expansion of other seemingly whimsical apps like play-to-earn games, decentralized social networks, Web3 marketing programs, DePIN projects, artist communities, and beyond.

The beauty of the open-sourced and financialized nature of the crypto industry is that it offers the creative outlet and incentive package necessary to attract developer talent which is currently producing a steady stream of new decentralized apps (Dapps). Following the thinking of Peter Diamandis in his book BOLD, these circumstances pluck the technology from the hands of the geeks and deposits it with the entrepreneurs—which is a sign something is set to become more mainstream.

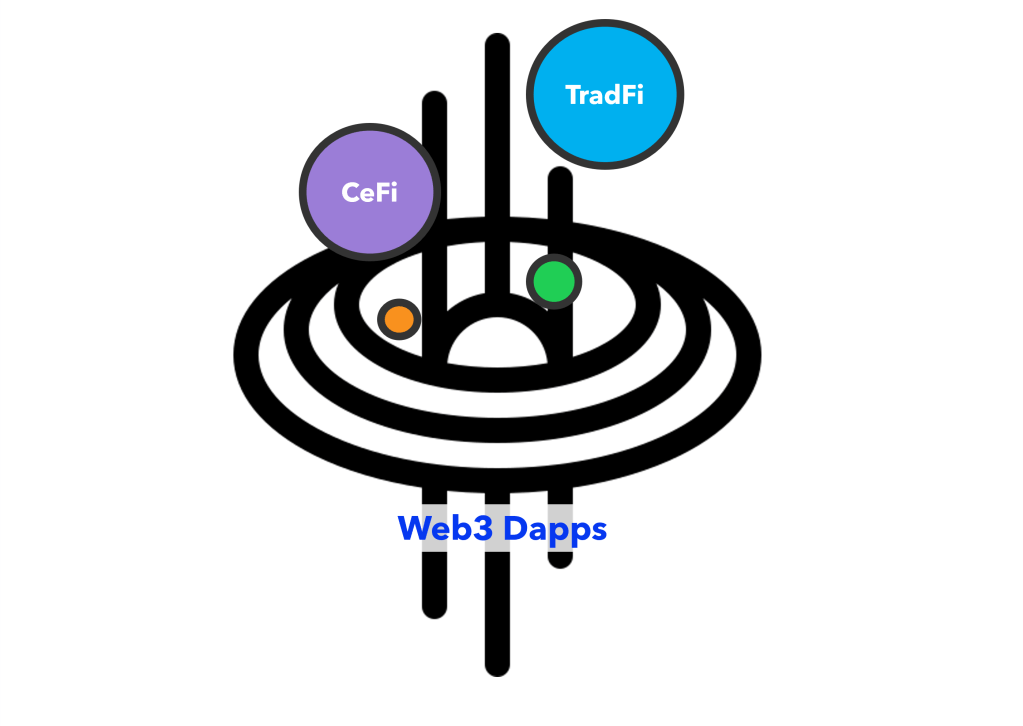

Web3 gateways are important pieces of infrastructure in this system. They provide the portal to let people in and out of this new alternate world, and therefore, they are the de facto way these Dapps will build their audiences.

Today, the Dapp world is relatively small… but it is growing exponentially.

Eventually, it will extend its reach outward, treading over the surface area of the financial system.

The Surface Area of Finance

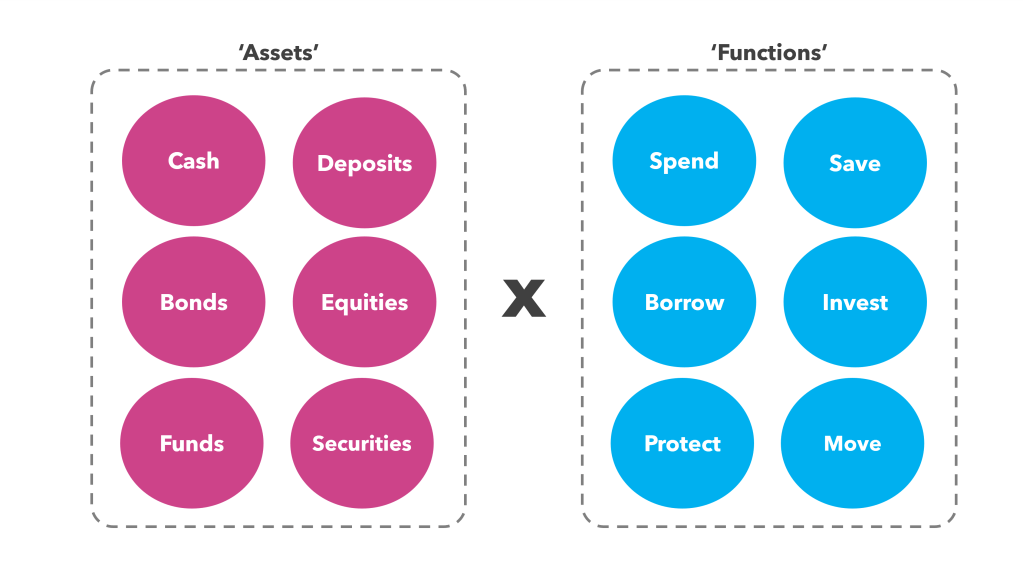

In the world of traditional finance (TradFi), there are ‘Assets’ and there are ‘Functions’ and the combination of the two make up most conceivable financial services today.

A checking account is ‘deposits’ x ‘spend’.

A savings account is ‘deposits’ x ‘save’.

An online brokerage account is ‘equities’ x ‘invest’.

A margin loan in that account would be ‘equities’ x ‘borrow’.

… you get the picture.

The CeFi (centralized finance) world operates on top of this aperture. (NOTE: CeFi is just a term for financial services that are provided through a single private entity as opposed to being administered in a decentralized manner. Coinbase—it’s primary custodial trading app, at least—is one of the largest CeFi platforms in the industry).

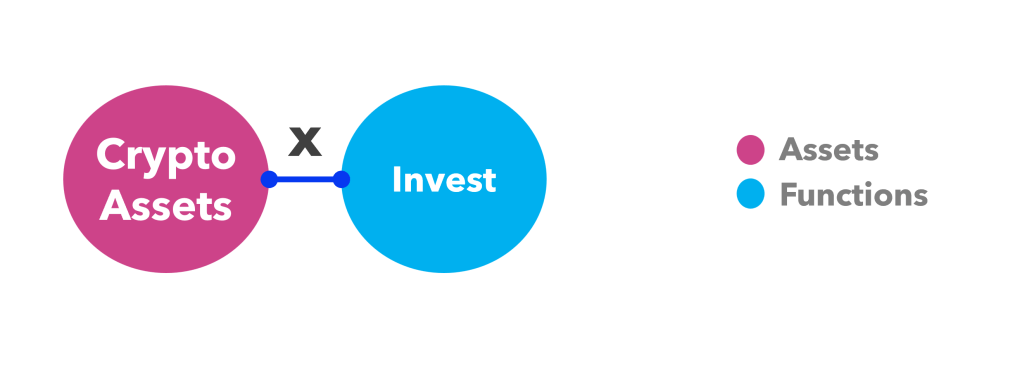

Because the CeFi model matured in the early speculative days of crypto and now exists in the regulated world of the traditional financial system, CeFi has the characteristic of being narrowly focused on two things: ‘digital assets’ and ‘investing’.

Speculating was (and arguably still is) the primary draw for new users into the ecosystem, so the focus on investing makes a lot of sense. However, crypto assets are a new type of money, and investing is only one slice of the numerous financial functions that exist (move, spend, save, borrow, invest, protect). Web3 gateways will be the key to opening up many of the others.

The Ever-expanding Web3 Universe

Opening up access to new functions starts to get at why Web3 gateways will become so important: Because they are the access point to the magical world of Web3. That world does not sit still. It is continuously expanding outward on the two aforementioned plains: functions and assets.

Functions: Crypto developers are constantly building new primitives on-chain, a sandbox of experimentation that promises novel ways to interact with on-chain assets. These include both financial and non-financial functions.

- Financial functions: move + spend + save + borrow + invest + protect + hypothecate + stream + transform + etc. à

- Non-financial functions: stake + collect + earn + engage + manage + play + govern + etc.

Assets: Whether on-chain or off-chain, the trend of financialization continues, from fine art and classic cars to Friend.tech keys and tokenized treasury bonds.

- Off-chain financialization of real world assets: Art + Cars + Collectibles + Commodities + Infrastructure + Real Estate + Recurring Revenue Streams + Etc.

- On-chain financialization: Tokenization bringing real-world assets (RWAs) on-chain, including the off-chain examples above + New emerging crypto-native assets (NFTs, security tokens, stablecoins, POAPs, SBTs, etc.)

The continuous expansion of these two plains creates a feedback loop: More assets on-chain mean more people are able to ‘access’ the new functions being created. More new functions are created to meet the demand of new assets as they move on-chain.

The flywheel is turning. Momentum is building. But today, it is nowhere near escape velocity.

Gateways as a Vector for Competition

As the breadth of on-chain services expands, the gateway to access them becomes more valuable and will have an important influence over financial services industry dynamics.

The first question is who will offer on-chain services in the future?

The one prerequisite of a Web3 gateway is that is also requires a non-custodial wallet to access. Eventually, we can expect other traditional finance firms to dabble in the non-custodial world. Robinhood already is, with their Robinhood Wallet app. Many CeFi firms are also exploring this (eg. Binance launched a self-custodial wallet a few months ago). Other crypto infrastructure players are already laying the groundwork for wallet-as-a-service facilities to offer plug-and-play installation for other TradFi and CeFi companies.

The second question is who will have gateways?

A gateway is much like the Apple App Store IF it could be easily copied and pasted by other technology companies. What if through the click of a button, Microsoft was able to make all of the applications on the App Store available to its Windows customers? In theory, that is how easy web3 gateways will be to install. Anyone can create one.

As the services behind the gateways become more valuable as the number of assets and functions on-chain multiplies, an inevitable gravity will be created that will pull firms (both TradFi and CeFi) toward non-custodial crypto.

Most consumer-oriented TradFi firms will likely go through a ‘crypto adoption process’ much like individuals do.

- First they dabble: reading about crypto, exploring where it could fit within their offering, etc.

- Then they take the first step: usually a custodial solution that involves only a few large tokens like Bitcoin or Ethereum

- Then they embrace it: this involves expanding their custodial offering across more asset types and functions, including crypto-native functions like staking or providing liquidity

- Then they jump-in head-first: they introduce a non-custodial service

- Only at this point, can they add a web3 gateway

Gateways will likely be a crypto-native advantage for a long time, at least until the rest of the financial services world works through the process above.

From Yahoo! Homepage to the App Store for Ownership

Today, Coinbase’s Web3 tab is a lot like Yahoo!’s original home page. It is a bunch of links to a variety of Dapps.

Tomorrow, it has endless possibilities thanks to the engine of innovation that the worlds largest financial sandbox provides.

As more and more firms start to recognize the value of the ever-expanding web3 universe, non-custodial services and gateways will become more common.

The competitive ground will start moving faster. It will become harder and harder to keep up with the non-custodial world.

To finish with another Alice in Wonderland quote: “It takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!”.

Continual striving just keeps you on par with the competition.

Web3 gateways can provide a leap ahead.