Last week, Lyft reported their second quarter earnings, and the release contained an interesting nugget about their future pricing plans. As per TechCrunch:

Lyft’s revenue per rider decreased almost 5% quarter-over-quarter, while the number of active riders increased in the second quarter to 21,487 riders, up from 19,552 in the first quarter. Lyft appears to be not only trying to keep prices competitive with Uber, it’s also working to kill off surge pricing, or “primetime” as the company calls it.

During Tuesday’s earnings call, Risher said that surge pricing might work to incentivize more drivers during peak service, but it also acts as a demand suppressor when riders don’t want to pay exorbitant fees just to get home after work. “[Primetime pricing] is a bad form of price raising. It’s particularly bad because riders hate it with a fiery passion. And so we’re really trying to get rid of it, and because we’ve got such a good driver supply…it’s decreased significantly.”

The end of surge pricing would be a ‘hallelujah’ moment for frequent ride sharing users. It also illustrates an increasingly common conundrum for companies: What happens when you know that a revenue stream that you currently depend on will eventually be competed away to nothing?

We can call the revenue stream in this scenario a revenue mirage: It is in sight today, but could vanish at any moment.

What Causes a Revenue Mirage

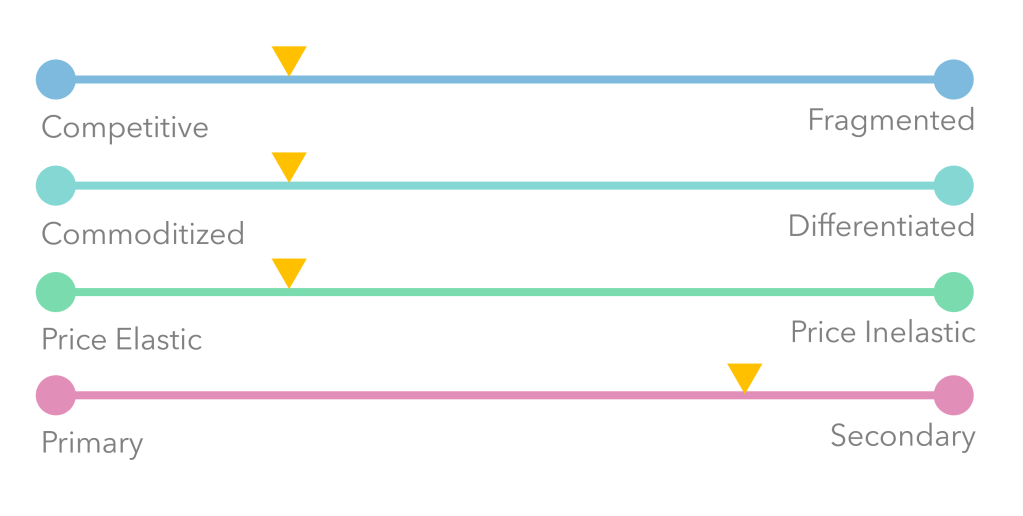

In today’s dynamic digital world, companies emerge, pivot, and fade away faster than ever before. This means competition acts quickly to shrink any competitive advantage and any associated margins and profitability. This is particularly true for digital products and services that fall on the ‘commodity’ end of the digital product spectrum and for products that are highly price elastic. In addition, if the revenue produced by that commoditized product could be categorized as secondary (one of several sources of revenue for a particular company), then you have the four ingredients for a revenue mirage: competition, commoditization, price elasticity and secondary in nature.

*This last ingredient, the secondary revenue line, is an important one because it allows continuity in the business model while allowing the revenue source to be competed away down to zero.

Revenue mirages can exist for long periods of time as long as a competitive equilibrium (or in game theory terms, a Nash Equilibrium) is maintained. As long as both Uber and Lyft maintain surge pricing, it will exist as a continuous source of revenue in the ride sharing industry.

But revenue mirages can vanish in a hurry if that equilibrium is broken. Once there is a competitive shot across the bow, the Nash equilibrium is broken and a new one must be found as the industry runs through the following cycle:

- A Unilateral Action…: A participant breaks the Nash equilibrium by changing their strategy [pricing] in an attempt to improve their own outcome.

- That Has an Impact on Others… The unilateral action by one participant can affect the outcomes and payoffs of the other participants. Depending on the nature of the deviation, other participants will need to adjust their strategies [pricing] in response to the change.

- Who React and Adjust…: Other participants assess the consequences of the deviation and decide how to respond. They might choose pricing strategies that optimize their outcomes in light of the changes introduced by the deviating participant.

- Dynamically Until a New Equilibrium is Reached: The situation can evolve dynamically as participants react to each other’s actions. Deviations and responses can lead to a sequence of adjustments until a new equilibrium is reached and everyone is happy.

Revenue Mirages From the Past

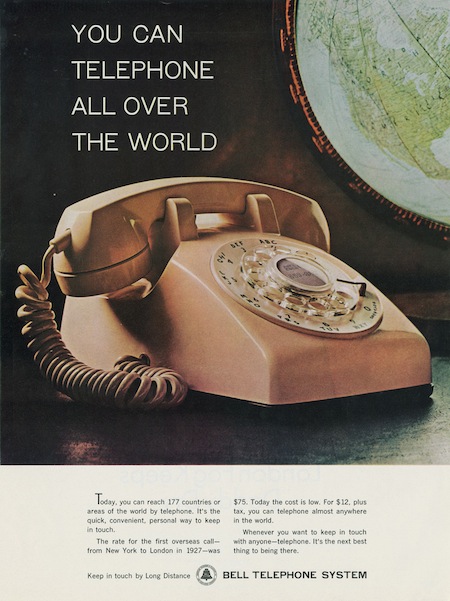

Long Distance Charges

Remember those long-distance charges you used to rack up on your landline phone bill? Well, the major telecommunications companies certainly do. In the 1990s, long-distance services contributed to a roughly 40%-50% of Sprint’s revenue and up to 50%-60% of AT&T’s.

These circumstances were clearly forming a revenue mirage:

- Competitive: telecommunications was (and still is) a capital intensive industry that coalesced around several large competitors

- Commoditized: like cellphone data and internet services today, landline phone services were as commoditized as they come with few features differentiating service providers

- Price elastic: consumers had highly visible pricing evident in their monthly phone bills and displayed a tendency to act when unhappy with their current provider

- Secondary: although long-distance charges made up substantial portions of revenue, they were secondary to the company’s primary source which came from recurring monthly phone bills.

What was the catalyst that broke the Nash Equilibrium? Arguably, it was when the Telecommunications Act of 1996 was signed into law. The Act encouraged the development of alternative providers, leading to the introduction of new pricing models and service packages. In order to hold on to its market leadership position, AT&T launched their “AT&T True Connections” service, which allowed residential customers to make unlimited domestic long-distance calls on evenings and weekends without incurring additional charges. This stood apart from the traditional per-minute long-distance pricing model that was dominant in the market at the time.

Once the ‘unlimited’ nights and weekends model was out in the market, it was easy to predict that the days of long-distance revenue charges were limited.

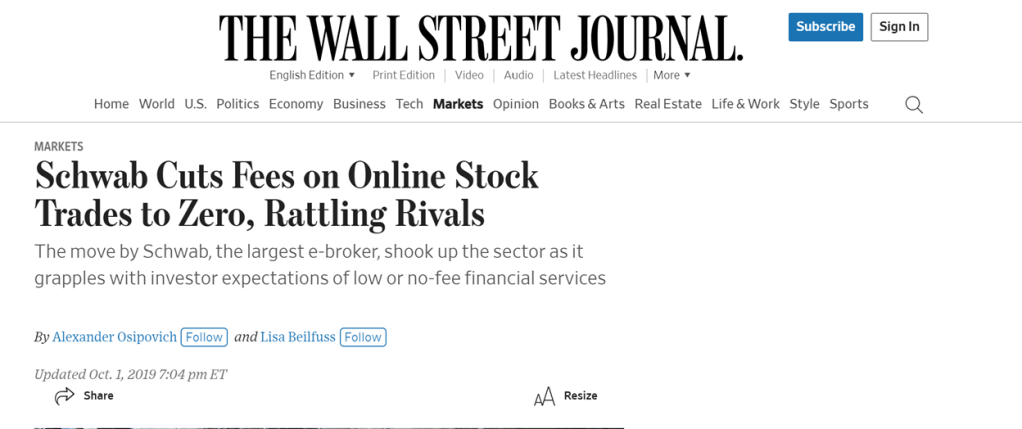

Stock Trading Commissions

Remember those flat trading commissions you used to have to pay each time you wanted to buy or sell a stock? Although most of us Canadians still do, it is a thing of the past in the U.S.

In late 2019, trading commissions in the U.S. online brokerage industry were:

- Competitive: there were several large players including Schwab, Fidelity and Ameritrade.

- Commoditized: each of those large players had a very similar value proposition to customers with platforms that offer similar features via a similar experience with a similar pricing model.

- Price elastic: consumers care deeply about their commission pricing, which is highly visible showing up as fee on each transaction.

- Secondary: while most people would think commissions would be the primary source of revenue for these companies given they’re the only true ‘sticker price’ a customer would see, they actually fall secondary to other revenue sources like net interest income and asset management revenue.

In this case, the equilibrium breaker came from one of the industry participants:

Seemingly out of nowhere, Schwab cut their trading commissions from $4.95 to $0, eliminating a major source of revenue from their income statement. With a heavily price sensitive customer base of traders, rivals E-Trade, Interactive Brokers and TD Ameritrade all dropped their commission fees in the weeks that followed.

Although commission prices had gone through waves of reductions in the past (giving us hints this was a revenue mirage), after Schwab made their move, most industry observers knew that commission revenue industry-wide was about to vanish.

Other Mirages

Surge pricing is also arguably a mirage [Uber investors take note]. Other examples include: credit reports, ATM fees, and operating systems (remember buying the latest version of Microsoft Windows?) to name a few.

How to Respond to a Mirage

Given that the three ingredients to a mirage are pretty common across industries, that must mean there are A LOT of mirages out there today—revenue lines just waiting to evaporate. So it begs the question: after identifying a mirage, what is the best way to respond? Well, the standard lawyer’s answer of ‘it depends’ applies here, but there are several different lenses to wear when thinking through this problem:

- What Will Break the Equilibrium: Eventually, either an external catalyst (regulation, technological advancements, customer demand, etc.) or a hungry competitor will come along to shatter the once peaceful pricing dynamic that existed around the mirage. Once the jig is up, game theory becomes the guide to a company’s next action. This will often drive a tit-for-tat exchange that either ends with the revenue source finding a new lower priced equilibrium or winnowing away to zero. If a revenue mirage is present, it becomes worthwhile to plan for this inevitable scenario ahead of time instead of having to react to your competitors’ moves.

- Optimize Revenue Offsets: Beyond analyzing and considering what might cause the mirage to fade, the next set of considerations is how to best optimize other streams of revenue in the face of potential change. In the online brokerage scenario, the first player who shifts to zero might do so in order to see a short-term customer acquisition gain, or to capture the brand goodwill that comes with being first and ‘doing the right thing’ for their customers. Schwab likely had both of these aims in mind, but little did anyone know, a partial motive was also to knock down the share prices of their competitors just in time to make a low-ball offer to acquire TD Ameritrade. A masterclass in optimizing revenue offsets.

- Optimize Consumer Surplus: If optimizing additional revenue streams is the logical step to take, then optimizing consumer surplus would be the psycho-logical next step to take. That is, what positive behavior changes might be created for the customer by way of the pricing change. Commission free stock trading means that investors can easily break their orders up into multi-leg orders over the course of the day, or nibble at a stock over the course of a week, and it makes entry and exits less stressful for the smaller investor. The removal of surge pricing means riders coming home from the bar at the busiest times may no longer be deterred by price and tempted to drive themselves home after a few pints. No more long-distance fees meant that college students could stay in touch with their families without fear of racking up a big bill and that Grandma wouldn’t feel guilty about keeping her kids and grandkids on the phone for a lengthy conversation. These are all big value adds that are often overshadowed by the dollars-and-cents of the pricing change itself, but they are worth highlighting to the customer and may even provide a kernel for a new revenue line or business model to emerge.

Outside of the different considerations above, there is also some finance logic to apply. Given that the mirage has been identified, it should be labeled as an unsustainable source of revenue, meaning when discounting those future cashflows in annual planning and budgeting sessions, a very steep rate should be applied. Since those future cashflows might not be worth as much to the organization through this lens, the incentive to be the one to break the equilibrium increases.

Just Do It

Revenue mirages used to be rare. Pricing dynamics were slow to evolve in industries in the pre-internet era since consumers only had local market knowledge at their fingertips. The internet has changed this, of course, along with birthing a variety of new business models.

Today, revenue mirages are everywhere. It’s a good idea to scan your business or industry for their presence because they either represent an opportunity or a major risk/liability. In either case, look for the four characteristics (competitive, commoditized, price elastic and secondary) to confirm their presence and follow the three considerations (what will break the equilibrium, what will optimize revenue offsets, what will optimize consumer surplus) to figure out a response.

Eventually, all roads will lead to the same answer. If something eventually has to be addressed, may as well take Nike’s slogan to heart and ‘Just Do It’. Those that rip the band-aid off first are likely to have the greatest advantage of all—having a proactive and thoughtful approach amongst a pool of competitors that are scrambling to react.